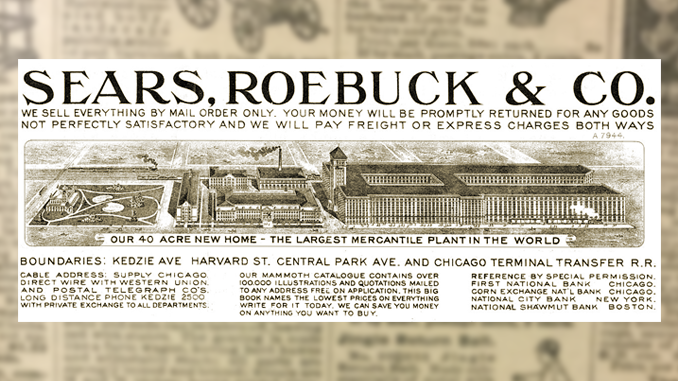

Its origins as a mail-order retailer of watches were modest.(Searsarchives.com) Nothing in its early days indicated the potential for greatness. Yet, less than five decades later, it had grown into the most extensive retail empire ever seen. (Smithsonian.com)

One could buy or order a seemingly unlimited range of goods—appliances, clothing, cosmetics, furniture, groceries, and even automobiles—from its stores and catalog. “The great price maker” appeared to be an indestructible and permanent feature of the American retail landscape.

Those golden days are now behind it. Today, the once magnificent retailer is in perhaps the final stages of its struggle to survive. The cumulative burden of organizational decay, inability to adapt to a changing retail market, short-sighted management, asset sales that hollowed the company’s competitiveness and undermined its brand, declining sales, chronic losses, and a shrinking supply chain has inflicted a devastating toll.

On October 15, 2018, Sears filed for Chapter 11 (law.cornell.edu) bankruptcy protection. In doing so, the company announced:

Sears Holdings Corporation… today announced a series of actions to position the Company to establish a sustainable capital structure, continue streamlining its operating model and grow profitably for the long term. To facilitate these actions, the Company and certain of its subsidiaries have filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of New York (the “Court”).

The Company expects to move through the restructuring process as expeditiously as possible and is committed to pursuing a plan of reorganization in the very near term as it continues negotiations with major stakeholders started prior to today’s announcement…

Holdings intends to reorganize around a smaller store platform of EBITDA-positive stores. The Company believes that a successful reorganization will save the Company and the jobs of tens of thousands of store associates. Holdings is currently in discussions with ESL regarding a stalking-horse bid for the purchase of a large portion of the Company’s store base. There can be no assurance that any transaction will be consummated or on what terms any transaction may occur. Additionally, Holdings expects to market and sell certain of the Company’s assets over the coming months.

Holdings will also close 142 unprofitable stores near the end of the year. Liquidation sales at these stores are expected to begin shortly. This is in addition to the previously announced closure of 46 unprofitable stores that is expected to be completed by November 2018.

The company also explained in its 8-K filing with the Securities and Exchange Commission that it may seek additional legal relief:

Based upon their continuing review, the Debtors may file additional motions seeking relief from the Bankruptcy Court to reject other leases and contracts. The Company is not able to estimate at this time the amount, nature and timing of restructuring and impairment charges that will be incurred as a result of these actions.

At present, Sears plans to seek a buyer for its remaining stores. According to its 8-K filing, the company has set a December 15, 2018 deadline to find a “non-contingent and fully-financed stalking horse bid” for its remaining stores.

The pursuit of a stalking horse bid is an effort by a company to gauge market interest in its assets ahead of a possible auction of those assets. If no bid is obtained, the debtor-in-possession lenders (the lenders who provided financing to allow Sears to continue its pared down operations during bankruptcy) could seek to have the company liquidated under Chapter 7 (law.cornell.edu) of the U.s. bankruptcy code.

These are grim times for the 132-year old American icon in retailing. Its probability of survival is low. The base case is its failure.

Its best chance at survival might depend on its ability to reorganize itself as a specialized retailer in home appliances centered on its Kenmore brand. However, a single brand may offer an insufficient foundation for successful emergence from bankruptcy. Should Sears manage to survive, it very likely will never regain its former dominance in the retail sector. Instead, it could remain a focused or niche retailer.

Given its past slow-motion liquidation under the management of former CEO Edward Lampert, its creditors may have little confidence in yet another turnaround strategy and even less patience to allow such an effort to proceed. Instead, they may view a near-term and orderly dissolution of the company’s remaining assets as providing them with their best prospects for the maximum recovery of their loans.

If Sears ultimately disappears from the American economy, Sears won’t be the first iconic company to fail. Further, given historic economic experience, it is likely that some of today’s icons will also vanish from the scene in coming decades, as the never-ending process of “creative destruction” described by Austrian political economist Joseph Schumpeter (Schumpeter’s Capitalism, Socialism, and Democracy) leads to the demise of formerly dominant firms and the rise of new companies.