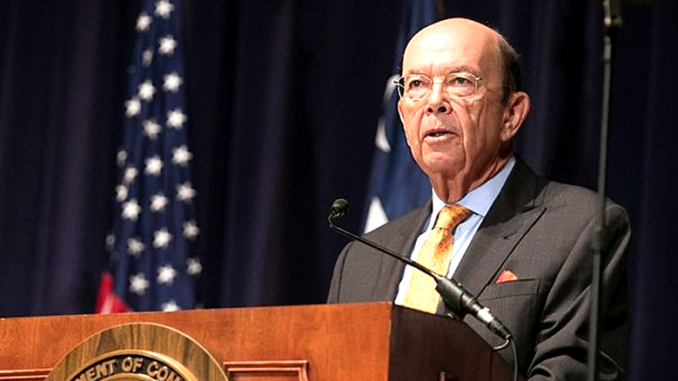

President Trump’s Commerce Secretary Wilbur Ross made the news again. This time with allegations surrounding a pattern for, well, grifting.

On Monday, in what was called a “bombshell” report by the Business Insider, Dan Alexander writing for Forbes dropped a piece titled, “New Details About Wilbur Ross’ Business Point To Pattern Of Grifting.”

Alexander sets the scene with this opening shot.

“A multimillion-dollar lawsuit has been quietly making its way through the New York State court system over the last three years, pitting a private equity manager named David Storper against his former boss: Secretary of Commerce Wilbur Ross. The pair worked side by side for more than a decade, eventually at the firm, WL Ross & Co. – where, Storper later alleged, Ross stole his interest in a private equity fund, transferred them to himself, then tried to cover it up with bogus paperwork…”

With $4 million riding on the outcome of the case, Ross and Storper agreed to settle before the trial could start. Two weeks ago.

Apparently, the implications is this case was on the down low. No one’s even heard about it, or reported on it, until now. It never came up in his Senate confirmation hearing either. Which begs the question, who on the Senate committee, if anyone, knew about it during his confirmation hearing? Did he fail to declare it, or did the Senate committee fail to inquire about it? After all, aren’t we talking about allegations of basically what amounts to embezzlement and fraud and a cover up?

Turns out Storper was one of Ross’ ex-business partners in his company WL Ross & Co, and while this may be a case started three years ago, Storper is just the most recent example in a list of people who have sued Wilbur Ross in what Alexander goes on to describe as a systematic pattern of defrauding business dealings with partners, investors, and clients alike, spanning well over a decade, one even resulting in an SEC fine for $2.3 million in 2016 for allegedly defrauding and misleading investors and having to refund $11.6 million he allegedly bilked of them.

For the story Alexander said that “over several months, in speaking with 21 people who know Ross, Forbes uncovered a pattern: Many of those who worked directly with him claim that Ross wrongly siphoned or outright stole a few million here and a few million there…” and that, “…all told, these allegations-which sparked lawsuits, reimbursements and an SEC fine-come to more than $120 million.”

Alexander goes on to lay out what appears to be laundry list of elaborate scams and schemes. Selling his company to what is now it’s parent company, that Ross is part owner, allegedly valuing it for more than Ross should have deserved. Collecting on what seems to be double dipping on management fees charges on investments, even one investment that was “essentially worthless.” Serving on the boards that his company represented and using it as a way to skim off the top of employee’s fees.

One of Ross’ former employees told Forbes that Ross was “like a kid in a candy store” and that Ross “pilfered it.”

Business Insider reported they reached out to the Commerce Department and was able to get a spokesperson there to make a statement on the Forbes report, which said in part, “The anonymously sourced Forbes story is based on false rumors, innuendo, and unverifiable claims” and adding further that earlier in the day Ross stated in response to it, “the SEC has never initiated any enforcement action against me.”

You can read the SEC’s facts, findings, and determinations in their report here.

By the time the SEC fine against Ross was announced his own portfolio was going down. “The future cabinet secretary’s private equity funds were underperforming – one on track to lose 26% and another two dribbling out mediocre returns – and the accusations started piling up.”

Then November 2016 Trump won the presidency and offered Ross a position in his administration as a member of his cabinet as the Secretary of Commerce, telling his supporters – this life long Democrat – was “a legendary Wall Street genius” and explaining to them, “I just don’t want a poor person.” As for Wilbur Ross, it offered him … “the perfect exit.”

In December 2016 an employee filed suit against Ross for $3.6 million saying Ross “looted” his account.

In November 2017 three former executives who worked at WL Ross are suing Ross and the company alleging that Ross ‘charged them improper fees’ to the tune of $48 million.

So is it really any surprise Ross now has Senate allegations of ethics violations, conflicts of interests, and possible insider trading and a request for an independent investigation by the OIG hanging over his head as President Trump’s Secretary of Commerce, someone who was described as “a pathological liar” by a former colleague in Alexander’s piece?

“[WASHINGTON, DC] – U.S. Senator Richard Blumenthal (D-CT) led a group of six Senators in calling on the Inspector General (IG) of the Commerce Department, Peggy Gustafson, to open an independent inquiry into Commerce Secretary Wilbur Ross’ compliance with ethics requirements…”

The Senators’ letter details several areas of concern, including:

- Ascertaining the true value of Secretary Ross’ personal wealth;

- Whether Secretary Ross has complied with the divestment requirements in his ethics agreement;

- Whether Secretary Ross has complied with the recusal requirements in his ethics agreement and the adequacy of that agreement; and

- Whether senior department officials have been allowed to serve despite conflicts of interest.

Why This Matters

All the President’s … Grifters. Indeed.