The US bond yield curve inverted. What does that mean for the markets?

CNBC – “Now that one of the most reliable recession indicators in the market got triggered, investors across the globe are starting to worry if this could mean the U.S. economy is slowing down.”

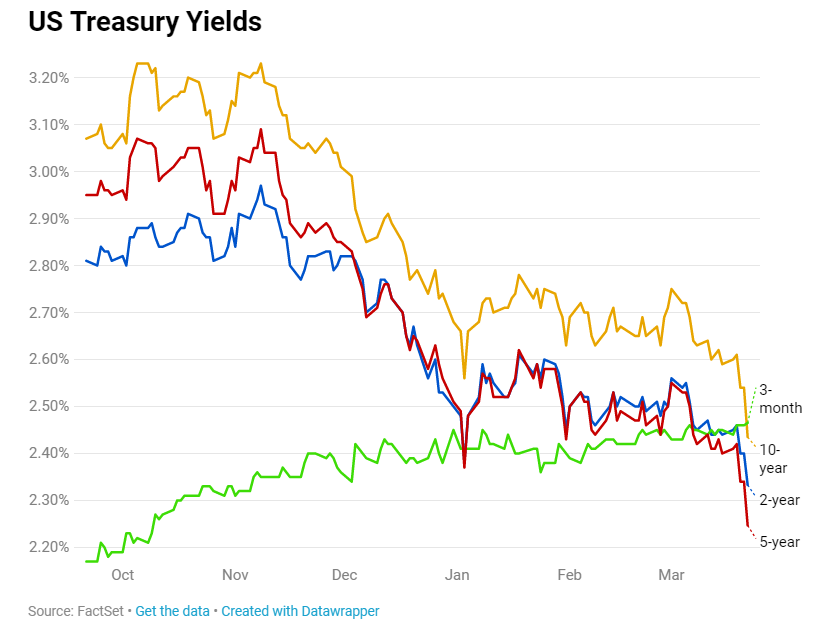

- Last week, the yield on the U.S. 10-year Treasury note dipped below the yield on the 3-month paper.

- The yield curve — which plots bond yields from shortest maturity to highest and is considered a barometer of economic sentiment — inverted on Friday for the first time since mid-2007

The yield on the U.S. 10-year Treasury note on Friday dipped below the yield on the 3-month paper. It was the first time since mid-2007 that the yield curve — which plots bond yields from shortest maturity to highest and is considered a barometer of economic sentiment — inverted.

(That part of the curve inverted again on Monday.)

CNBC Market Insider

CNBC explains what that means for the market.

CNBC – “Bond market says not only is a recession coming, but the Fed will cut interest rates to stop it.”

- Fed funds futures were pointing to a quarter point in easing Monday, as traders said scary signals continued to emanate from the bond market.

- On Friday, there was a so-called inversion in the yield curve, meaning very short rates rose above longer 10-year note rates, a fairly reliable recession signal.

- Traders say the bond market may be overreacting, while stocks seem to be ignoring the recession warnings and fears the Fed will have to jump in with one or more rate cuts to stop the economy from rolling over.

The bond market doubled down on scary warnings Monday, signaling both a possible recession is looming and that the Fed could have to cut interest rates this year to stop it.

“People are starting to get fearful,” said Andrew Brenner of National Alliance. “It won’t last for long, but they’re getting fearful about a recession. You had a Fed that changed course 180 degrees and then added to it last week. That caught the market off guard.”

The disconnect between stocks and bonds was fairly dramatic Monday, after the bond market flashed a recession warning Friday. The Dow traded as much as 100 points on both sides of unchanged Monday, but the bond market reflected a flight to safety trade, with yields falling across the curve from the shortest duration securities to the longest. The Dow ended up 16 at 25,516, while the S&P 500 fell 2 points, to 2,798.

The move was also global, with the German 10-year bund yield falling to a negative 0.03 percent.

“The 10-year is inverted versus the current fed funds. It should signal expectations that rates are going to be lower in the future, which would be consistent with notable risk of a recession,” said Jon Hill, U.S. fixed income strategist at BMO. “One of the fascinating things is the stock market is taking this in stride. The Fed is trying to extend this cycle as long as it can. Whether it will be enough is difficult to say.”

h/t LiliVonShtupp for this market update Tuesday via MarketWatch:

Consumer confidence falls in March in another sign of economic anxiety (New housing starts also fell and missed expectations, fwiw.)

The so-called present situation index sank 12 points 160.6, marking the

biggest one-month decline since the middle of the last recession in

2008.

On A Side Note (Opinion)