Last Wednesday the Committee on Oversight and Reform government held a hearing on the DOD Inspector General Report on Excess Profits by TransDigm Group, Inc.

TransDigm Group Incorporated “develops, distributes and manufactures commercial and military aerospace components such as mechanical actuators and ignition systems,” and is, according to their own *About* page [emphasis mine*]: “a leading global designer, producer and supplier of highly engineered aircraft components, systems and subsystems for use on nearly all commercial and military aircraft in service today.

Surface background.

Transdigm Incorporated was established in 1993 by W. Nicholas Howley and Douglas W. Peacock after acquiring Adel Fasteners, Aero Products Component Services, Controlex Corporation and Wiggins Connectors from IMO Industries.

Four years later, in 1997, the company purchased Marathon Power Technologies. The next year, Transdigm Incorporated was acquired by Odyssey Investment Partners. Then, during the final two years of the century, the company added to its list of acquisitions with Adams Rite Aerospace and Christie Electric.

In May 2001, Transdigm Incorporated procured Champion Aviation Products, a supplier of igniters, spark plugs and oil filters from Federal-Mogul Corporation for approximately $160 million. It was at this time that Nicholas Howley took over the position of Chief Executive Officer from Douglas Peacock as Peacock transferred into his role as Chairman of the Board.

Inaccurate filings with Department of Defense and “hidden monopoly.”

On January 20, 2017, Citron Research (CR) published a report on TransDigm highlighting its debt-financed acquisitions followed by deep cost cuts and “price gouging”. CR published another report on March 9, 2017, accusing TransDigm of illegal activity, noting that twelve of its subsidiaries failed to report their common ownership on federal forms under penalty of perjury. CR pointed out that this omission could be used to defeat federal procurement cost controls.

On March 21, 2017, U.S. Representative Ro Khanna (CA-D) wrote a letter to the DOD Inspector General that described “waste, fraud, and abuse” by TransDigm Group, that TransDigm was operating as a “hidden monopoly” “because its subsidiaries failed to report their common corporate ownership” with the DoD and asked the IG to investigate.

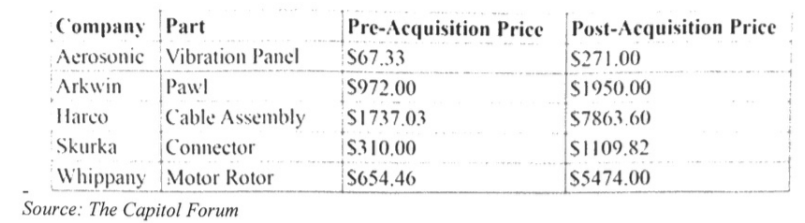

Khanna’s letter described large price increases that occurred after suppliers acquired by TransDigm and said that the omission of their ownership of their subsidiaries allowed TransDigm to dodge DoD requirements that monopoly suppliers report their costs.

From the letter: “Below is a chart detailing the price for five aerospace parts before TransDigm acquired the parts manufacturer and the price for the same parts after TransDigm acquired the manufacturer:”

“TransDigm appears to use a rang of methods to evade these protections,” Khanna’s letter continues.

“For example, according to reports, TransDigm avoids showing that it is a monopoly provider of parts by setting up a network of captive distributors that mimic the aesthetics of a competitive market. Despite the illusion of competition, distributors that provide TransDigm parts, for the most part, are buying from one TransDigm subsidiary, and that subsidiary sets its price to distributors. The procurement officer, however, sees multiple sellers of the product, without realizing that he or she is in fact buying from a monopoly.”

Rep. Khanna’s letter asked the DoD Inspector General to investigate (1) TransDigm price increases borne by DoD and whether performance improvements were behind the increases, (2) how procurement officers would have treated TransDigm differently had their filings been accurate, (3) how to lower short-term costs to DoD of procurement from TransDigm subsidiaries.

According to a Tuesday Bloomberg report: Pentagon Contractor’s 9,400% Profit on Half-Inch Pin Challenged reported that the Committee on Oversight and Reform hearing on the DOD Inspector General’s report conclusions from February would be held on Wednesday.

The review found potential excess profits for 98 of 100 parts sampled and concluded the Pentagon may end up paying TransDigm $91 million more in coming years for parts valued at $28 million, with excess profit per part of 95% to the 9,380%, the Defense Department’s inspector general said in an audit labeled “For Official Use Only” and obtained by Bloomberg News.

As the Pentagon weighs whether to recommend legislation to require more disclosure by contractors, the House Committee on Oversight and Reform will review the audit and TransDigm’s pricing policies in a hearing on Wednesday.

On Wednesday, Bloomberg reported: “TransDigm Group Inc. is “gouging our taxpayers” with spare parts markups that were as high as 4,451% from 2015 through 2017 as it repeatedly declined to provide backup data on costs, according to a Pentagon official.

“Once TransDigm refused to provide the requested cost data” for at least 15 parts during those years, “our contracting officers were left with the limited options” of either buying the parts without receiving the information or “not buying the parts needed to meet mission requirements,” Kevin Fahey, assistant defense secretary for acquisition, said in a statement submitted Wednesday to a House committee.

“Is what TransDigm is doing illegal? No,” Fahey said. “Do I consider gouging our taxpayers for excessive costs immoral and unconscionable in the face of getting our warfighters what they need to fight? Yes.”

Fahey commented as Representative Elijah Cummings, chairman of the House Committee on Oversight and Reform, released a memo and convened the hearing on the parts charges and whether the Defense Department needs new authority to press contractors on their cost and profit calculations.

The Pentagon faces potentially even greater markups, including more than 9,400% for a half-inch metal pin that could cost the government $4,361, under a new contract signed in July 2018 with TransDigm, Bloomberg News reported Tuesday.

Rep. Khanna Opening Statement: DOD Inspector General Report on Excess Profits by TransDigm Group

Oversight Committee

Published on May 15, 2019

Full hearing below: DOD Inspector General Report on Excess Profits by TransDigm Group, Inc.

Start 22:47 – Jim Jordon opening statement.

Start 25:34 – Khanna introduces the panel, which includes two TransDigm representatives, founder Nicholas Howley and CEO Kevin Stein, followed by the DoD Inspector General’s opening statement.

*[Emphasis mine]

TransDigm’s Response

TransDigm’s Chief Executive Officer Kevin Stein in his prepared statement to the committee that the Pentagon’s inspector general “did not audit or (to use the colloquial term) ‘investigate’ TransDigm.”

“Rather, it audited the procurement practices of the Defense Logistics Agency and other government buying agencies” and “in doing so, the IG found that TransDigm did nothing in contravention of the federal acquisition laws and regulations with respect to its pricing.”

Stein said Cleveland-based TransDigm is primarily a commercial supplier, “not a traditional defense contractor.” …

Bloomberg

For full content and context:

Pentagon Contractor’s 9,400% Profit on Half-Inch Pin Challenged; May 14, 2018; Bloomberg Politics.

Pentagon Rips TransDigm for ‘Gouging’ With $4,361 Half-Inch Pin; May 15, 2018; Bloomberg Politics.