A study of figures from the United Nations identified China as the world’s new leader in direct foreign investment, rising 4% year-over-year to $163 billion. The United States, by comparison, brought in $134 billion, a drop of 49%.

Much of the shift is due to concerns over the COVID-19 response and the effects it had on industry and production, but while the degree of change was anomalous, the directional trend was not.

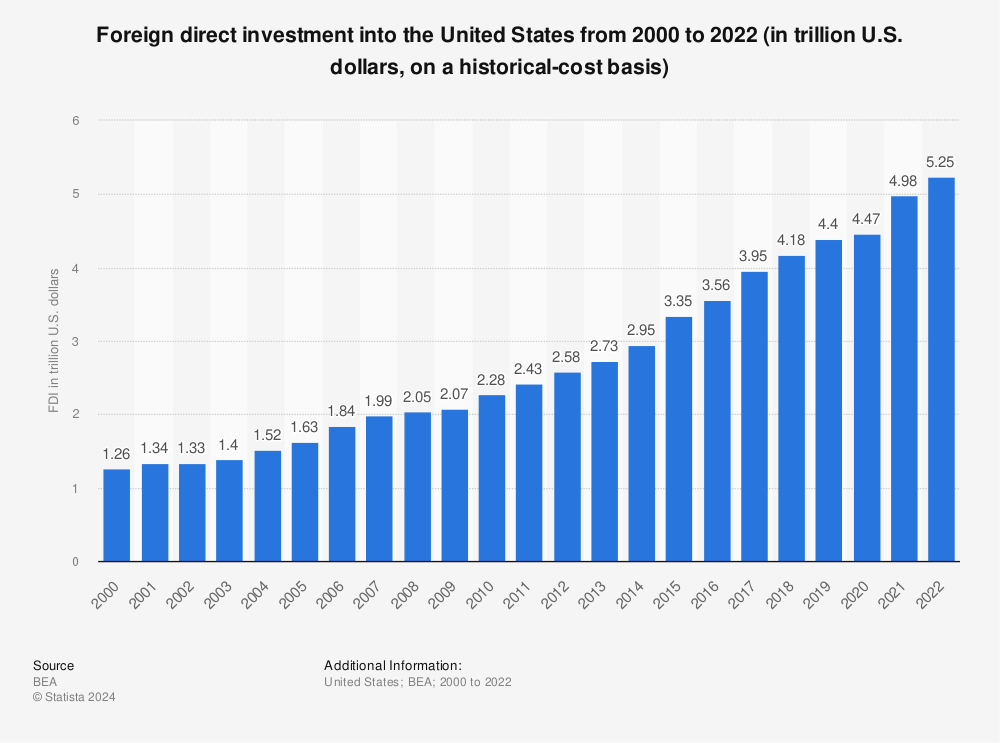

The United States saw anemic foreign investment in 2017, as the “America First” policy was enacted. This changed in 2018 and 2019, as the appearance of a strong stock market continued to draw in foreign investors.

China’s growth curve has been much steeper; if looking at the absolute quantity of foreign direct investment, it has risen from a mere 587 billion in 2010 (a little less than half of the 2000 mark on the chart above) to almost 2 trillion today (about 2007 US levels).

Their growth has been particularly strong over the last four years, where the successful completion of two different “Belt and Road” trade routes – while in 2016 the international consensus was that existing US trade and defense agreements would likely preclude even one such route being completed – have combined with the China’s active pursuit of free trade agreements to heighten their economic influence throughout the world.

Existing investment remains strongly in favor of the United States; as indicated above, direct foreign investment in China is currently roughly half that of the United States, even following the disastrous 2020. But the direction of investment provides worrisome indicators for American influence in the world, which in turn risks weakening the long-term stability of the dollar.