It’s Friday.

President Shitshow’s public schedule for…

| Friday, July 18 2025 |

| 9:00 AM In-Town Pool Call Time In-Town Pool |

| 1:30 PM The President participates in a Swearing-In Ceremony for the Commissioner of the Internal Revenue Service Oval Office Closed Press |

| 2:30 PM The President participates in a Signing Ceremony for S.1582 GENIUS Act East Room Pre-Credentialed Media |

| 7:00 PM The President participates in a Dinner with Republican Senators State Dining Room Closed Press |

House Vote:

| 07/17/2025-3:54pm | On passage Passed by the Yeas and Nays: 308 – 122 (Roll no. 200). Action By: House of Representatives |

Senate Vote:

| Date | All Actions |

|---|---|

| 06/17/2025 | Passed Senate with an amendment by Yea-Nay Vote. 68 – 30. Record Vote Number: 318. (text: CR S3419-3432) Action By: Senate |

| 06/12/2025 | Cloture on the bill, as amended invoked in Senate by Yea-Nay Vote. 67 – 27. Record Vote Number: 312. Action By: Senate |

| 06/12/2025 | S.Amdt.2307 Amendment SA 2307 agreed to in Senate by Yea-Nay Vote. 67 – 30. Record Vote Number: 311. Action By: Senate |

| 06/12/2025 | S.Amdt.2307 Motion to waive all applicable budgetary discipline with respect to amendment SA 2307 agreed to in Senate by Yea-Nay Vote. 64 – 33. Record Vote Number: 310. Action By: Senate |

| 06/12/2025 | S.Amdt.2310 Motion to table amendment SA 2310 rejected in Senate by Yea-Nay Vote. 45 – 52. Record Vote Number: 309. Action By: Senate |

| 06/11/2025 | S.Amdt.2307 Cloture on amendment SA 2307 invoked in Senate by Yea-Nay Vote. 68 – 30. Record Vote Number: 305. Action By: Senate |

| 05/21/2025 | Motion to proceed to consideration of measure agreed to in Senate by Yea-Nay Vote. 69 – 31. Record Vote Number: 263. Action By: Senate |

| 05/19/2025 | Second cloture motion on the motion to proceed invoked in Senate by Yea-Nay Vote. 66 – 32. Record Vote Number: 262. (CR S2965) Action By: Senate |

| 05/08/2025 | Cloture on the motion to proceed to the measure not invoked in Senate by Yea-Nay Vote. 48 – 49. Record Vote Number: 240. (CR S2823) Action By: Senate |

CBO.gov as passed by the Senate (06/17/2025):

Legislation Summary

S. 1582 would define payment stablecoin to mean a digital asset issued for a payment or settlement that is pegged to a reference asset, such as the U.S. dollar, and redeemable at a fixed amount. The act also would establish a regulatory framework for stablecoin issuers. Nonbank entities or subsidiaries of insured depository institutions could apply to become issuers; within three years of enactment only those approved issuers would be authorized to offer stablecoin. Once approved, an issuer would be subject to supervision by appropriate federal or state regulators and would be required to hold at least one dollar of permitted reserves for every dollar issued in stablecoin.

Under S. 1582, the responsible federal financial regulators would be the Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), Office of the Comptroller of the Currency (OCC), and the Federal Reserve.

S. 1582 would permit nonbank entities with less than $10 billion in issuance to opt in to a state regulatory system, provided that the state’s system is substantially similar to its federal counterpart; state regulators could choose to cede their authority to the Federal Reserve. The act would require federal and state regulators to issue specific capital, liquidity, and risk management rules for federal and state stablecoin issuers and to report on stablecoins. The Financial Crimes Enforcement Network (FinCEN) would be required to issue anti-money-laundering rules for stablecoin issuers.

CBO.gov as passed by the Senate (06/17/2025).

Estimated Federal Cost

The estimated budgetary effect of S. 1582 is shown in Table 1. The costs of the legislation fall within budget functions 370 (commerce and housing credit) and 750 (administration of justice).

CBO.gov as passed by the Senate (06/17/2025).

Basis of Estimate

Enacting S. 1582 would impose additional administrative costs on the federal financial regulators, CBO estimates. We expect that during the two years after enactment, the regulatory agencies would conduct rulemaking, develop industry and examiner guidance, train examiners, and establish processes for state and federal regulation of small issuers of stablecoins. After that, the agencies would incur additional administrative costs for examinations, risk monitoring, enforcement, and certifying state regulators. Using information from the affected agencies, CBO estimates that, on average, the annual cost in 2025 of employing a financial regulatory staff member at the FDIC, NCUA, OCC, and Federal Reserve is $270,000. Costs in later years are adjusted to account for anticipated inflation.

CBO.gov as passed by the Senate (06/17/2025).

Direct Spending

The administrative costs of the FDIC, NCUA, and OCC are classified in the federal budget as direct spending. Using information from those agencies, CBO estimates that enacting the legislation would increase gross direct spending by $77 million over the 2025-2035 period. However, OCC and NCUA collect fees from financial institutions to offset their costs; those fees are treated as reductions in direct spending. Thus, CBO estimates that, on net, enacting the legislation would increase direct spending by $47 million over the same period.

CBO.gov as passed by the Senate (06/17/2025).

Revenues

Costs incurred by the Federal Reserve reduce remittances to the Treasury, which are recorded in the budget as revenues. CBO estimates that enacting S. 1582 would decrease revenues by $73 million over the 2025-2035 period. Changes in costs for the Federal Reserve banks have historically resulted in changes to remittances during the same year. However, since fiscal year 2023, the central bank has recorded a deferred asset to account for accrued net losses from expenses in excess of income. As a result, remittances largely have been suspended. In CBO’s projections, remittances from the Federal Reserve will generally be suspended until 2030, and until they resume, most changes in costs incurred by the system will not be recorded as changes in remittances.[1]

CBO.gov as passed by the Senate (06/17/2025).

Spending Subject to Appropriation

S. 1582 would require FinCEN to write anti-money-laundering rules for stablecoin issuers. That agency’s administrative costs are funded through annual appropriations. CBO estimates that implementing the provision would cost less than $500,000 over the 2025-2030 period; any related spending would be subject to the availability of appropriated funds.

CBO.gov as passed by the Senate (06/17/2025).

Uncertainty

The regulatory framework established under S. 1582 would change the way traditional financial institutions interact with digital assets. CBO has estimated only the additional administrative costs of enacting S. 1582 and has not estimated any other budgetary effects—either for the financial system specifically or for the federal budget overall, including the effects on Treasury yields—that would arise from changes to the banking sector.

CBO cannot predict the magnitude or direction of any budgetary effects because they depend on uncertain factors, including growth in stablecoin use, changes in bank deposits, or enhanced efficiency or disruptions for the financial markets or the banking industry. CBO also cannot determine whether state regulators would cede authority to the Federal Reserve.

CBO.gov as passed by the Senate (06/17/2025).

Pay-As-You-Go Considerations

The Statutory Pay-As-You-Go Act of 2010 establishes budget-reporting and enforcement procedures for legislation affecting direct spending or revenues. The net changes in outlays and revenues that are subject to those pay-as-you-go procedures are shown in Table 1.

Increase in Long-Term Net Direct Spending and Deficits

CBO estimates that enacting S. 1582 would not increase net direct spending by more than $2.5 billion in any of the four consecutive 10-year periods beginning in 2036.

CBO estimates that enacting S. 1582 would not increase on‑budget deficits by more than $5 billion in any of the four consecutive 10-year periods beginning in 2036.

CBO.gov as passed by the Senate (06/17/2025).

Mandates

The legislation would impose intergovernmental and private-sector mandates as defined in the Unfunded Mandates Reform Act (UMRA). CBO estimates that the total cost of those mandates would not exceed the threshold established in UMRA for intergovernmental mandates but would exceed the threshold for private-sector mandates ($103 million and $206 million in 2025, respectively, adjusted annually for inflation).

CBO.gov as passed by the Senate (06/17/2025).

Intergovernmental Mandate

Some states (such as New York) have implemented laws specifically governing some aspects of stablecoin issuance. Other states (including Texas) have applied their existing money transmission laws to the transmission of stablecoins. S. 1582 would impose an intergovernmental mandate by preempting certain state laws that regulate stablecoins. Although the preemption would limit the application of state laws, it would impose no duty on state governments that would result in additional spending or loss of revenue. The act would not require states to govern or continue to govern stablecoins and would allow states to simply cease their current regulatory practices.

CBO.gov as passed by the Senate (06/17/2025).

Private-Sector Mandates

The legislation would require stablecoin issuers and offerors (including those in secondary markets) to comply with new financial regulations and reporting requirements, which is a private-sector mandate. The act would require stablecoins to be backed by reserves that are tied to a fiat currency.Currently, some stablecoin issuers “maintain the peg” with an adjacent cryptocurrency or with an algorithm for supply and demand. Stablecoin issuers also would be required to make their redemption policies public.

To comply with the legislation, stablecoin issuers and offerors would probably have to restructure their business practices or potentially divest from issuing and selling noncompliant stablecoins in the United States. CBO cannot determine the exact cost of the mandate because the act would allow federal regulatory agencies to exempt some stablecoin issuers from complying with certain provisions. However, the entities likely to be affected are large multinational companies with market capitalizations in the hundreds of billions of dollars. Using publicly available information on the current business practices of stablecoin issuers and information from industry experts, CBO estimates that the aggregate cost of the mandate would greatly exceed the private-sector threshold established in UMRA.

If the federal financial regulators increase annual fee collections to offset the costs of implementing provisions in the act, S. 1582 would increase the cost of an existing private-sector mandate on entities required to pay those fees. CBO estimates that the incremental cost of that mandate would be small.

CBO.gov as passed by the Senate (06/17/2025).

President Angry at the World for not loving him more than their own lives looks forward to signing the bill into law this afternoon.

#EPSTEIN FILEGATE

President Big Mad is Bigly mad that The Wall Street Journal—that well-known bastion of Marxist thought—exposed his 2003 birthday fan mail to Jeffrey Epstein on Thursday.

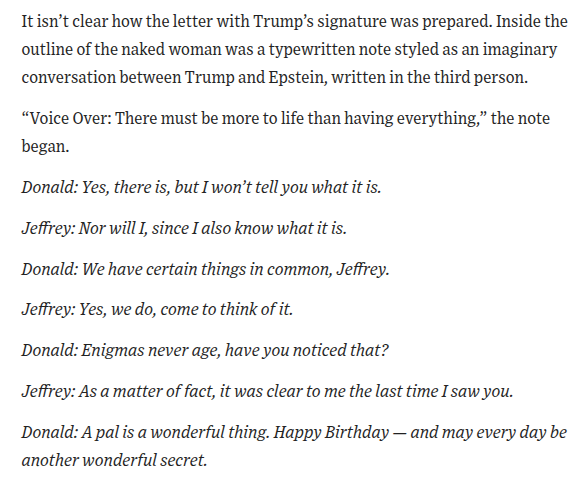

It was Jeffrey Epstein’s 50th birthday, and Ghislaine Maxwell was preparing a special gift to mark the occasion. She turned to Epstein’s family and friends. One of them was Donald Trump.

Maxwell collected letters from Trump and dozens of Epstein’s other associates for a 2003 birthday album, according to documents reviewed by The Wall Street Journal.

Pages from the leather-bound album—assembled before Epstein was first arrested in 2006—are among the documents examined by Justice Department officials who investigated Epstein and Maxwell years ago, according to people who have reviewed the pages. It’s unclear if any of the pages are part of the Trump administration’s recent review.

[snip]

The letter bearing Trump’s name, which was reviewed by the Journal, is bawdy—like others in the album. It contains several lines of typewritten text framed by the outline of a naked woman, which appears to be hand-drawn with a heavy marker. A pair of small arcs denotes the woman’s breasts, and the future president’s signature is a squiggly “Donald” below her waist, mimicking pubic hair.

The letter concludes: “Happy Birthday — and may every day be another wonderful secret.”

In an interview with the Journal on Tuesday evening, Trump denied writing the letter or drawing the picture. “This is not me. This is a fake thing. It’s a fake Wall Street Journal story,” he said.

“I never wrote a picture in my life. I don’t draw pictures of women,” he said. “It’s not my language. It’s not my words.”

He told the Journal he was preparing to file a lawsuit if it published an article. “I’m gonna sue The Wall Street Journal just like I sued everyone else,” he said.

The Wall Street Journal. 07/17/2025.

This is how they reported the letter from President Big Mad to Epstein.

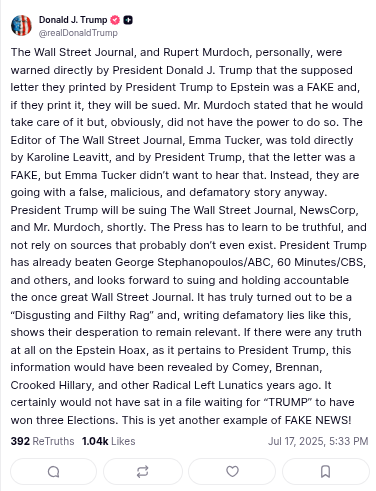

Big Mad melted down via “lies social” over the story.

Sent at 8:33 PM D.C., time.

VP Eyeliner obviously hadn’t gotten the talking points based on the post he sent on twitter @7:53 PM D.C., time:

Forgive my language but this story is complete and utter bullshit. The WSJ should be ashamed for publishing it.

— JD Vance (@JDVance) July 17, 2025

Where is this letter? Would you be shocked to learn they never showed it to us before publishing it? Does anyone honestly believe this sounds like Donald Trump? https://t.co/KHsTFOSl34

In a bold attempt to squash #EpsteinFileGate (for real this time), President Big Mad directed his bestie and part-time Attorney General cosplayer Pam Bondi to release all “pertinent Grand Jury testimony, subject to Court Approval.” Because if there’s one thing President Big Mad is famous for, it’s following court orders to the letter.

President Trump—we are ready to move the court tomorrow to unseal the grand jury transcripts. pic.twitter.com/hOXzdTcYYB

— Attorney General Pamela Bondi (@AGPamBondi) July 18, 2025

@9:57 PM D.C., time President Big Mad once again said the letter wasn’t his words and he doesn’t draw pictures.

First Son “Daddy Doesn’t Love Me” tried to help his “daddy” out by lying on twitter.

“In 47 years, I’ve never seen my father doodle.” https://t.co/YblfT3BYJK pic.twitter.com/nvUwF6KRlF

— Isaac Saul (@Ike_Saul) July 18, 2025

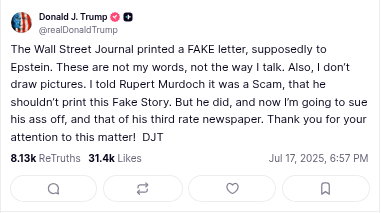

This morning, President Big Mad—furious over a “Democrat Hoax” that is “fake”—continued to be Bigly Mad about the letter that is also, somehow, “fake.”

@8:04 AM D.C., time:

So, the other day, President Glitching A-Lot wondered aloud how former President Biden managed to appoint Jerome Powell as Fed Chair. In light of that glitch, one has to ask: when he says “Comey,” does he mean James — the one he fired back in May 2017 — or James’s daughter Maurene, who was fired just two days ago? Inquiring minds wanna know!

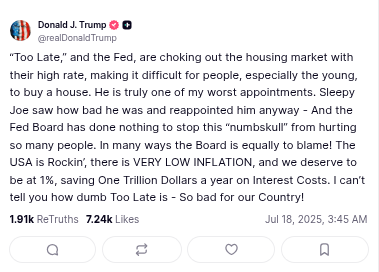

@9:17 AM D.C., time:

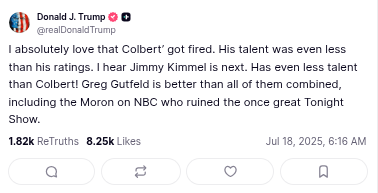

In a valiant attempt to distract from #EpsteinFileGate, President Big Mad fired off random attacks on the Fed Chair, posted a link to The Right Scoop, celebrated a TV show getting cancelled, and reminded us all that “Sean Hannity really gets it.” Riveting stuff from the leader of the free world.

In other related news, for the first time in recent memory, the Trump Administration willingly shared a health update on President Could-Live-to-200-If-He’d-Just-Quit-the-Cheeseburgers.

Leavitt: "Recent photos of the president have shown minor bruising on the back of his hand. This is consistent with minor soft tissue irritation from frequent hand-shaking and the use of aspirin." pic.twitter.com/OE4BaFvNrP

— Aaron Rupar (@atrupar) July 17, 2025

In breaking news.

There has been an explosion at the Eugene Biscailuz Regional Training Center in Los Angeles, CA. The explosion has left at least 3 people dead. AG Bondi confirmed the explosion on twitter.

I just spoke with @LACoSheriff Luna. We have @FBI and @ATFHQ agents on the ground to support.

— Attorney General Pamela Bondi (@AGPamBondi) July 18, 2025

Please pray for the entire Los Angeles County Sheriff’s Department. https://t.co/6T9OIfh6dg

CNN reported that the training facility “houses the sheriff’s department’s special enforcement units and bomb squad, around 7:30 a.m. local time, a senior law enforcement source familiar with the incident told CNN.”