It’s Friday.

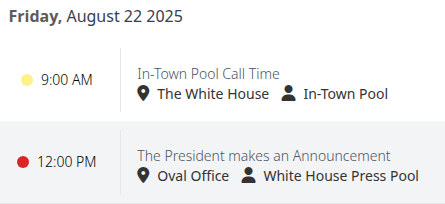

President Shitshow’s public schedule for…

President Media Hog is set to make an “announcement” this afternoon, which probably means we’re in for another episode of As the Ego Turns — loud, pointless, and starring only him.

This morning FBI Director Kash Patel tweeted…

NO ONE is above the law… @FBI agents on mission

— FBI Director Kash Patel (@FBIDirectorKash) August 22, 2025

Minutes later the New York Post said:

Patel’s FBI raids John Bolton’s home in high-profile national security probe https://t.co/Mthavk4heL pic.twitter.com/GpZSjJcOGE

— New York Post (@nypost) August 22, 2025

FBI agents raided the DC-area home of President Trump’s former national security adviser John Bolton on Friday morning in a high-profile national security probe, The Post can exclusively reveal.

Federal agents went to Bolton’s house in Bethesda, Md., at 7 a.m. in an investigation ordered by FBI Director Kash Patel, a Trump administration official told The Post.

[snip]

The probe — which is said to involve classified documents — was first launched years ago, but the Biden administration shut it down “for political reasons,” according to a senior US official.

New York Post. 08/22/2025.

If this probed is stemming from an investigation that was launched years ago, it’s over his 2020 book “The Room Where it Happened”.

The Guardian from September 2020:

A former National Security Council official who while working there reviewed John Bolton’s memoir for classified information before publication, has claimed that White House lawyers tried to pressure her into signing misleading statements to prevent the publication ofthe book.

The allegations come a week after the US Department of Justice launched a criminal investigation into whether Bolton, the former national security adviser, mishandled classified information in his book, The Room Where It Happened. Highly critical of Trump, the book was a bestseller when it was published in June, selling 780,000 copies in its first week.

In a letter filed in federal court in Washington on Wednesday, lawyers for Ellen Knight, the former senior director for records, access and information security management at the NSC, said that her prepublication review of Bolton’s book had actually cleared it in April.

[snip]

But Knight’s lawyers allege that White House officials then conducted their own review of Bolton’s revised manuscript and claimed it still contained classified information, in a process that Knight called “fundamentally flawed”. Knight alleges that the officials then tried “to get her to admit that she and her team had missed something or made a mistake”, which could be used to support their argument to block publication.

Knight then declined to sign a declaration saying that Bolton’s book still contained classified information, intended to be filed in the lawsuit against Bolton. Despite efforts from what she described as “a rotating cast of Justice Department and White House attorneys … over the course of five days and a total of 18 hours of meetings”, she refused.

“Ms Knight asked the attorneys how it could be appropriate that a designedly apolitical process had been commandeered by political appointees for a seemingly political purpose. She asked them to explain why they were so insistent on pursuing litigation rather than resolving the potential national security issues through engagement with Ambassador Bolton and her team,” the letter reads. “The attorneys had no answer for her challenges, aside from a rote recitation of the government’s legal position that Ambassador Bolton had violated his contractual obligations by failing to wait for written clearance.”

The Guardian from September 2020.

President Dictator showed up in a red hat blaring “TRUMP WAS RIGHT ABOUT EVERYTHING” and got asked about the raid on former National Security Advisor John Bolton’s house. His response? Bolton’s “not a smart guy” but maybe “unpatriotic.” Translation: when all else fails, call the people who worked closest to you traitors and hope nobody notices the clown hat.

Trump on John Bolton: "He's not a smart guy. But he could be a very unpatriotic guy. We're gonna find out." pic.twitter.com/DjQigdVQdN

— Aaron Rupar (@atrupar) August 22, 2025

President I Don’t Know Anything about Anything claimed in one clip he “didn’t know anything about it.” Then, in the very next breath, he bragged about telling Pam (AG Bondi) and the “group” he didn’t “wanna know about it,” before reminding everyone he could direct it since he’s the “chief law enforcement officer.” Translation: I know nothing, I control everything — classic Trump logic.

Trump on FBI raiding Bolton's house: "I could know about it. I could be the one starting it. I'm actually the chief law enforcement officer." pic.twitter.com/1HjkPU9AJc

— Aaron Rupar (@atrupar) August 22, 2025

In opinion: This is probably the first of many people that will get a visit from the FBI because they dare to criticize the Orange Wonder of Stupid.

In Economic News…

Federal Reserve Chairman Jerome Powell gave a speech this morning that highlighted the economic outlook going forward.

Because they do not suck the Federal Reserve has already posted his remarks.

Powell: "This slowdown is much larger than assessed just a month ago, as the earlier figures for May and June were revised down substantially. But it does not appear that the slowdown in job growth has opened up a large margin of slack in the labor market, an outcome we want to… pic.twitter.com/BOVbTXStdb

— Aaron Rupar (@atrupar) August 22, 2025

This distinction is critical [remarks start here] because monetary policy can work to stabilize cyclical fluctuations but can do little to alter structural changes.

The labor market is a case in point. The July employment report released earlier this month showed that payroll job growth slowed to an average pace of only 35,000 per month over the past three months, down from 168,000 per month during 2024 (figure 2).2 This slowdown is much larger than assessed just a month ago, as the earlier figures for May and June were revised down substantially.3 But it does not appear that the slowdown in job growth has opened up a large margin of slack in the labor market—an outcome we want to avoid. The unemployment rate, while edging up in July, stands at a historically low level of 4.2 percent and has been broadly stable over the past year. Other indicators of labor market conditions are also little changed or have softened only modestly, including quits, layoffs, the ratio of vacancies to unemployment, and nominal wage growth. Labor supply has softened in line with demand, sharply lowering the “breakeven” rate of job creation needed to hold the unemployment rate constant. Indeed, labor force growth has slowed considerably this year with the sharp falloff in immigration, and the labor force participation rate has edged down in recent months.

Federal Reserve.gov. 08/22/2025.

Powell: "GDP growth has slowed notably in the first half of this year, to a pace of 1.2%, roughly half the 2.5% pace in 2024. The declining growth has largely reflected a slowdown in consumer spending … higher tariffs have begun to push up prices in some categories of goods." pic.twitter.com/4uVTBseEcg

— Aaron Rupar (@atrupar) August 22, 2025

Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.

At the same time, GDP growth has slowed notably in the first half of this year to a pace of 1.2 percent, roughly half the 2.5 percent pace in 2024 (figure 3). The decline in growth has largely reflected a slowdown in consumer spending. As with the labor market, some of the slowing in GDP likely reflects slower growth of supply or potential output.

Turning to inflation, higher tariffs have begun to push up prices in some categories of goods. Estimates based on the latest available data indicate that total PCE prices rose 2.6 percent over the 12 months ending in July. Excluding the volatile food and energy categories, core PCE prices rose 2.9 percent, above their level a year ago. Within core, prices of goods increased 1.1 percent over the past 12 months, a notable shift from the modest decline seen over the course of 2024. In contrast, housing services inflation remains on a downward trend, and nonhousing services inflation is still running at a level a bit above what has been historically consistent with 2 percent inflation (figure 4).4

The effects of tariffs on consumer prices are now clearly visible. We expect those effects to accumulate over coming months, with high uncertainty about timing and amounts. The question that matters for monetary policy is whether these price increases are likely to materially raise the risk of an ongoing inflation problem. A reasonable base case is that the effects will be relatively short lived—a one-time shift in the price level. Of course, “one-time” does not mean “all at once.” It will continue to take time for tariff increases to work their way through supply chains and distribution networks. Moreover, tariff rates continue to evolve, potentially prolonging the adjustment process.

Federal Reserve.gov. 08/22/2025.

Powell: "FOMC members will make these decisions based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach." pic.twitter.com/n5ej2EMV5P

— Aaron Rupar (@atrupar) August 22, 2025

Putting the pieces together, what are the implications for monetary policy? In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

Monetary policy is not on a preset course. FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach.

Federal Reserve.gov. 08/22/2025.

To summarize: Rate cut likely in September (before the holidays) and a hold for the December meeting and more rate cuts for 2026. This is all subjective he said nothing directly about the cuts just sent out signals.

It should be noted that given Powell’s remarks these rate cuts are not based in optimism of the outlook of our economy. They fear the recession that didn’t come before is coming now.