It’s Wednesday…

President Shitshow’s public schedule for…

| Wednesday, July 23 2025 |

| 9:00 AM In-Town Pool Call Time The White House In-Town Pool |

| 1:00 PM Press Briefing by the White House Press Secretary Karoline Leavitt James S. Brady Press Briefing Room On Camera |

| 4:35 PM The President departs The White House en route Andrew W. Mellon Auditorium The White House In-Town Travel Pool |

| 5:00 PM The President delivers remarks and signs Executive Orders at AI Summit Andrew W. Mellon Auditorium Pre-Credentialed Media |

| 5:55 PM The President arrives The White House The White House In-Town Travel Pool |

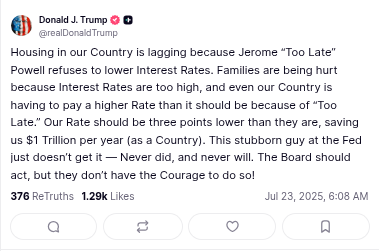

Before launching into his usual tariff fairy tales, our Liar-in-Chief took a moment on Lies Social to bash Fed Chair Jerome Powell — because nothing says “sound economic strategy” like blaming the Fed for problems you created. Then, with a straight face and a keyboard, he bragged that his trade deals are “great” for America — when in reality, they’re a win for foreign manufacturers and a loss for every U.S. consumer with a checkout total.

07/23/2025 @ 9:08 AM D.C., time:

He’s mad the Fed won’t drop rates like it’s a clearance sale, ranting about “courage” — while the economic policy he’s pitching feels like it was co-authored by chaos and caffeine. Honestly? Schizophrenia in PowerPoint form.

FYI:

Fannie Mae (12/11/2024):

This has caused potential homebuyers, mortgage lenders, and other market observers to ask us — why have mortgage rates risen despite the Fed cutting rates?

The short answer is this: The federal funds rate is the interest rate at which banks lend money to one another overnight, meaning it’s an interest rate on very short-term lending. Interest rates on other short-term bonds and loans move very closely with changes in the federal funds rate. The 30-year mortgage, on the other hand, is a long-duration loan and thus has a different rate at which market participants are willing to lend. This rate is determined in the bond market.

Fannie Mae (12/11/2024).

Bank Rate.com (06/18/2025):

That’s because fixed-rate mortgages — the most popular type of home loan — don’t mirror the federal funds rate; they track the 10-year Treasury yield. When that goes up or down, fixed-rate mortgage rates do, too. Again, the two rates aren’t exactly the same. Your mortgage rate will be higher than the 10-year yield by an amount known as a spread or margin.

[snip]

While fixed-rate mortgages dominate the U.S. residential financing scene, some Americans prefer adjustable-rate mortgages (ARMs), which have variable interest rates that reset annually or semi-annually. The Fed’s moves can affect them more directly.

More specifically, the rates on ARMs are often tied to the Secured Overnight Financing Rate, or SOFR. Because the Fed’s rate decisions serve as a basis for savings instruments, raising or lowering the fed funds rate can push the SOFR up or down. ARM rates, in turn, go up or down when the rate resets.

All this means that, if the federal funds rate goes up, your ARM rate will increase at the next adjustment.

Bank Rate.com (06/18/2025).

I got the sources from ChatGPT; it gave me more, I just selected two.

On with the Tariffs!

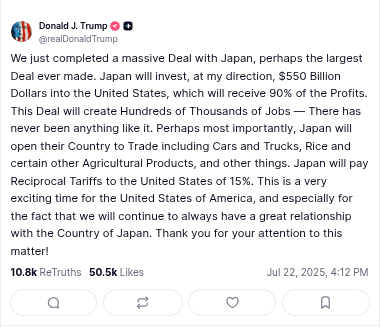

07/22/2025:

@ 7:12 PM D.C., time (this post is posted twice on his feed):

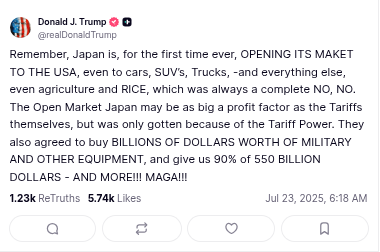

07/23/2025:

@9:18 AM D.C., time:

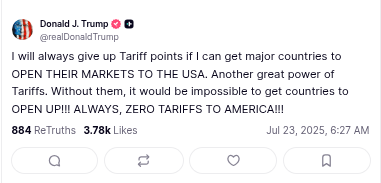

@ 9:23 AM D.C., time:

@ 9:27 AM D.C., time:

@ 9:36 AM D.C., time:

As always—and I know you know this—but just as a reminder: any tariff placed on U.S. imports from foreign countries is paid by U.S. consumers, not the foreign governments. We now have evidence suggesting that President Tariff knows this too, based on the careful wording in his latest announcement. His claim that “Japan will pay” is, quite simply, false. Japan won’t pay. We will.

This is an open thread

PS:

Sorry about the delay today; my PC decided this morning to freeze several times. I blame Chrome.

PSS.

We lost a legend yesterday in the form of Ozzy Osborne. I wasn’t a huge listener of his music, but his impact on music is undeniable.

These aren’t his only songs, these are the songs on my playlist.