It’s Friday.

President Shitshow’s public schedule for…

| Friday, August 1 2025 |

| 9:00 AM In-Town Pool Call Time In-Town Pool |

| 11:00 AM The President receives his Intelligence Briefing Cabinet Room Closed Press |

| 2:40 PM Out-of-Town Travel Pool Call Time Out-of-Town Travel Pool |

| 4:00 PM The President departs The White House en route Bedminster, NJ The White House Open Press |

| 5:40 PM The President arrives Bedminster, NJ |

Today is the Friday when we all pretend the U.S. president controls the economy—at least, that’s what I’d say if we weren’t living under President Orange Delusion Syndrome. I miss normal. But normal left in January 2025, and last I heard, it was spotted in a witness protection program under an assumed name.

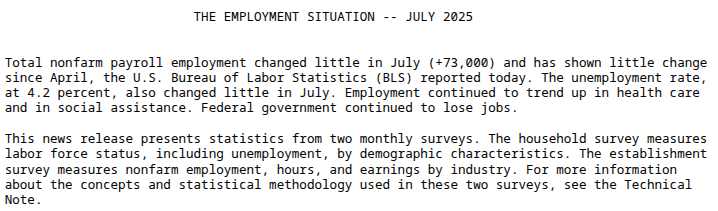

BLS.gov (08/01/2025):

For July they say we added 73,000 new jobs.

Revisions from May and June are grim.

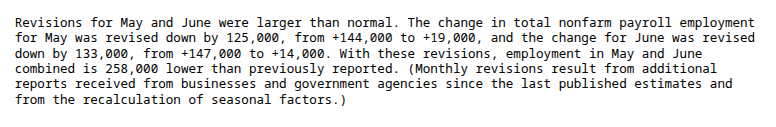

I found this part interesting.

Fox Business predictably lost their minds over the latest jobs report, but don’t worry—Charles Payne was there to save the day with his brilliant insight: the Fed only cares about the wealthy while ignoring the struggles of the majority of regular people. Because heaven forbid we blame President Economically Illiterate’s spectacularly awful economic policies. Nope, it’s obviously all Jerome Powell’s fault. Shocking, right?

LOL — it took about two minutes for Maria and company to find someone (other than Trump) to blame for the "very weak" July jobs report: it's Jerome Powell's fault! pic.twitter.com/APJokcElkL

— Aaron Rupar (@atrupar) August 1, 2025

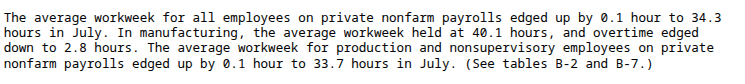

Minutes later, as predictable as the California sun showing up on schedule, President Grasping at Economic Straws was right back blaming the Fed chair—because obviously, it can’t be his mess. But hey, “the good news” is that the U.S. consumer is enthusiastically stuffing the tariff coffers. Yeah, nothing says economic genius like taxing your own people to pay for your mistakes.

Earlier Friday, the President who never grew up called Fed Chair Powell a “stubborn MORON” — all because the Fed held interest rates steady like everyone expected. Then, in all caps (because nothing says grown-up like yelling on social media), President Begging Powell to swoop in and save the economy—failing thanks to his own disastrous policies—warned that if Powell doesn’t fix things, the “BOARD SHOULD ASSUME CONTROL.”

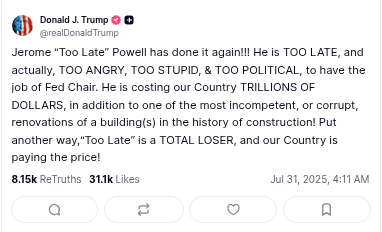

Ahead of yesterday’s Fed Board meeting, President Melt Down absolutely melted the fuck down, calling Fed Chair Powell “TOO ANGRY, TOO STUPID, & TOO POLITICAL” to be Fed Chair, and wrapping up his meltdown by labeling Powell a “TOTAL LOSER.”

He went on to all cap at the Fed Chair…

There were two dissents, but not for the reasons President Idiot thinks…

Statement by Vice Chair for Supervision Michelle W. Bowman

Bowman believes the inflation spike from tariffs will be temporary—though that’s unlikely, since these are blanket tariffs affecting all goods, not just some. However, she does see signs that the labor market is starting to stall. Without the tariff-driven inflation shock, the overall inflation rate would fall within the Federal Reserve’s target range.

The U.S. Economy Has Remained Resilient

The U.S. economy has remained resilient in the first half of the year. Although underlying economic growth has slowed markedly, the labor market has remained stable near estimates of full employment. We have also seen meaningful progress in lowering inflation toward our 2 percent target, excluding tariff-related increases in goods prices.Private domestic final purchases have increased at a much slower pace this year as compared to strong gains in 2024, reflecting softening consumer spending, and declining residential investment. This weakness in demand likely reflects elevated interest rates, slower growth in personal income, and smaller liquid asset buffers and elevated credit card utilization rates among lower-income households.

Total payroll employment continued to increase moderately, and the unemployment rate remained historically low in June. However, the labor market has become less dynamic and shows increasing signs of fragility. The employment-to-population ratio has dropped significantly this year, businesses are reducing hiring but continue to retain their existing workers, and job gains have been centered in an unusually narrow set of industries that are less affected by the business cycle, including health care and social services.

In the absence of tariff effects on goods prices, the 12-month change in core personal consumption expenditures (PCE) prices would have been less than 2.5 percent in June, lower than its elevated reading of 2.9 percent in December and considerably closer to our 2 percent target. This progress reflects the recent considerable slowing in core PCE services inflation, which is consistent with recent softness in consumer spending and the labor market no longer being a source of inflation pressures.

Statement by Vice Chair for Supervision Michelle W. Bowman. 08/01/2025.

Statement by Governor Christopher J. Waller

Waller also views the tariffs as a “one-off” increase. He then lays out three reasons for supporting a rate cut, arguing that a wait-and-see approach just isn’t viable: “since we will likely not get clarity on tariff levels or their ultimate impact on the economy over the course of the next several months, it is possible that the labor market falters before that clarity is obtained—if it ever is obtained. When labor markets turn, they often turn fast. If we find ourselves needing to support the economy, waiting may unduly delay moving toward appropriate policy.”

First, tariffs are one-off increases in the price level and do not cause inflation beyond a temporary increase. Standard central banking practice is to “look through” such price-level effects as long as inflation expectations are anchored, which they are.

Second, a host of data argues that monetary policy should now be close to neutral, not restrictive. Real gross domestic product (GDP) growth was 1.2 percent in the first half of this year and is expected to remain soft for the rest of 2025, much lower than the median of FOMC participants’ estimates of longer-run GDP growth. Meanwhile, the unemployment rate is 4.1 percent, near the Committee’s longer-run estimate, and total inflation is close to our target at just slightly above 2 percent if we put aside tariff effects that I believe will be temporary. Taken together, the data imply the policy rate should be around neutral, which the median FOMC participant estimates is 3 percent, and not where we are—1.25 to 1.50 percentage points above 3 percent.

My final reason to favor a cut now is that while the labor market looks fine on the surface, once we account for expected data revisions, private-sector payroll growth is near stall speed, and other data suggest that the downside risks to the labor market have increased. With underlying inflation near target and the upside risks to inflation limited, we should not wait until the labor market deteriorates before we cut the policy rate.

I fully respect the views of my colleagues on the FOMC that suggest we need to take a “wait and see” approach regarding tariffs’ effects on inflation. There is nothing wrong about having different views about how to interpret incoming data and using different economic arguments to predict how tariffs will impact the economy. These differences are a sign of a healthy and robust policy discussion.

But, I believe that the wait and see approach is overly cautious, and, in my opinion, does not properly balance the risks to the outlook and could lead to policy falling behind the curve. The price effects from tariffs have been small so far, and since we will likely not get clarity on tariff levels or their ultimate impact on the economy over the course of the next several months, it is possible that the labor market falters before that clarity is obtained—if it ever is obtained. When labor markets turn, they often turn fast. If we find ourselves needing to support the economy, waiting may unduly delay moving toward appropriate policy.

My position does not mean I believe the FOMC should reduce the policy rate along a predetermined path. We can cut now and see how the data evolves. If the tariff effects do not lead to a major shock to inflation, the Committee can continue reducing the rate at a moderate pace. If we do get significant upside surprises to inflation and employment, we can pause. But I see no reason that we should hold the policy rate at its current level and risk a sudden decline in the labor market.

Statement by Governor Christopher J. Waller. 08/01/2025.

I want to stress that in normal times, the President isn’t usually the reason the economy goes up or down. Free market capitalism is pretty good at rolling with whatever new policies come out of the White House or Congress. It adapts, adjusts, and keeps moving.

But from April 2025 through today, every single piece of bad economic news? That’s 100 percent on this President’s policies. And we know it—because the administration is already scrambling to have the policy rescued before it even takes full effect.

And it’s not just the tariffs. It’s the toxic combo of mass deportation and blanket tariffs that’s dragging the economy down.

Again, I want to be clear: in normal times, we’d be talking about a whole mix of reasons the economy shifted. But these aren’t normal times. We’re so far removed from normal, we probably wouldn’t even recognize it if it bit us on the ass and said, “Hi, I’m normal.”

This is an open thread