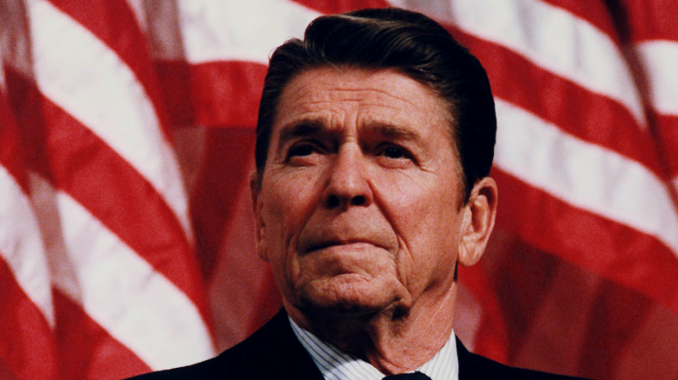

Today, a second return to the February 1981 address to the nation on the economy, made just sixteen days into the Reagan administration:

We know now that inflation results from all that deficit spending. Government has only two ways of getting money other than raising taxes. It can go into the money market and borrow, competing with its own citizens and driving up interest rates, which it has done, or it can print money, and it’s done that. Both methods are inflationary.

We’re victims of language. The very word “inflation” leads us to think of it as just high prices. Then, of course, we resent the person who puts on the price tags, forgetting that he or she is also a victim of inflation. Inflation is not just high prices; it’s a reduction in the value of our money. When the money supply is increased but the goods and services available for buying are not, we have too much money chasing too few goods. Wars are usually accompanied by inflation. Everyone is working or fighting, but production is of weapons and munitions, not things we can buy and use.

Now, one way out would be to raise taxes so that government need not borrow or print money. But in all these years of government growth, we’ve reached, indeed surpassed, the limit of our people’s tolerance or ability to bear an increase in the tax burden. Prior to World War II, taxes were such that on the average we only had to work just a little over 1 month each year to pay our total Federal, State, and local tax bill. Today we have to work 4 months to pay that bill.

Some say shift the tax burden to business and industry, but business doesn’t pay taxes. Oh, don’t get the wrong idea. Business is being taxed, so much so that we’re being priced out of the world market. But business must pass its costs of operations — and that includes taxes — on to the customer in the price of the product. Only people pay taxes, all the taxes. Government just uses business in a kind of sneaky way to help collect the taxes. They’re hidden in the price; we aren’t aware of how much tax we actually pay.

Little has changed since 1981. We still experience “Tax Freedom Day” – where the direct federal, state and local taxes for an average individual are paid for the year and a person can (theoretically) finally start earning money for essentials – in late April. Corporate taxes continue to be transferred to customers, who thus have their real Tax Freedom Day some time well past April… now that they’ve covered their own yearly taxes, they get to cover their part of corporate taxes for a few weeks.

So, what worked to rein in the dual problems of unemployment and inflation?

I’ve already placed a freeze on hiring replacements for those who retire or leave government service. I’ve ordered a cut in government travel, the number of consultants to the government, and the buying of office equipment and other items. I’ve put a freeze on pending regulations and set up a task force under Vice President Bush to review regulations with an eye toward getting rid of as many as possible. I have decontrolled oil, which should result in more domestic production and less dependence on foreign oil. And I’m eliminating that ineffective Council on Wage and Price Stability.

But it will take more, much more. And we must realize there is no quick fix. At the same time, however, we cannot delay in implementing an economic program aimed at both reducing tax rates to stimulate productivity and reducing the growth in government spending to reduce unemployment and inflation.

Here, again, is why context is important. Trump’s advocates will point to the fact that he lowered taxes and reduced regulation, just like Reagan. But he did so while greatly increasing spending, undermining any benefit which might have been seen from tax cuts (and there are valid questions, based on what was happening on the international markets, the artificially low interest rates for business loans and the US job market at the time, about how much actual stimulus was possible through tax cuts); and in many cases the regulations cut were only in friendly industries and even then in manners which reverted authority from mid-level bureaucrats not to the individual but rather highly placed government officials… functionally acting in the exact reverse of what had worked in the past.

One can point to the fact that spending did, in fact, increase under Reagan. Granted that many of the expansions were due to the demands of Congress, Reagan also sought to expand and modernize our military in the face of overt threats from the Soviet Union and antagonistic actors in the Middle East. But there was a fairly successful effort to slash much of the domestic spending, and there were actual belt-tightening requirements at government offices. The spending under Reagan was nothing like the spending under Trump, or much of the spending policies supported by other Presidents and other Congresses. Instead we’ve had domestic transformation agendas at the expense of a large portion of our useful military fleet under Obama and money diverted from actual military operations to a useless vanity project wall under Trump.

This is not necessary spending, and we are in a much deeper fiscal hole than we were during Reagan’s time.

We know the danger. We know what worked. And with that, I’ll return to a man who I happily acknowledge was better than me at most things, absolutely including communication:

We can create the incentives which take advantage of the genius of our economic system — a system, as Walter Lippmann observed more than 40 years ago, which for the first time in history gave men “a way of producing wealth in which the good fortune of others multiplied their own.”

Our aim is to increase our national wealth so all will have more, not just redistribute what we already have which is just a sharing of scarcity. We can begin to reward hard work and risk-taking, by forcing this Government to live within its means.

Over the years we’ve let negative economic forces run out of control. We stalled the judgment day, but we no longer have that luxury. We’re out of time.

And to you, my fellow citizens, let us join in a new determination to rebuild the foundation of our society, to work together, to act responsibly. Let us do so with the most profound respect for that which must be preserved as well as with sensitive understanding and compassion for those who must be protected.

We can leave our children with an unrepayable massive debt and a shattered economy, or we can leave them liberty in a land where every individual has the opportunity to be whatever God intended us to be. All it takes is a little common sense and recognition of our own ability. Together we can forge a new beginning for America.

We averted an economic judgement day in the 1980s and issued in a decade of prosperity. That decade is long past, and our failure to learn from history has returned us to the edge of an economic precipice. We know what happened in the past, we know why it happened, and we know how it was corrected. It’s up to us to use that knowledge wisely.