President Biden’s public schedule for St. Patrick’s Day Friday (03/17/2023):

| 9:00 AM | The President receives the Presidential Daily Briefing Closed Press |

| 9:50 AM | In-Town Pool Call Time In-Town Pool |

| 10:30 AM Bilateral Meeting | The President holds a bilateral meeting with H.E. Leo Varadkar, Taoiseach of Ireland Oval Office In-House Pool Spray |

| 11:45 AM | The President departs the White House en route to the Friends of Ireland Caucus St. Patrick’s Day Luncheon South GroundsIn-Town Travel Pool |

| 12:00 PM Lunch | The President attends the Friends of Ireland Caucus St. Patrick’s Day Luncheon In-Town Travel Pool Spray |

| 5:00 PM Shamrock Presentation & Reception | The President hosts H.E. Leo Varadkar, Taoiseach of Ireland, for a Shamrock presentation and reception at the White House; The Vice President and The Second Gentleman East Room Pooled for TV and Pre-Credentialed Media |

| 6:15 PM | Out-of-Town Pool Call Time Joint Base Andrews Overhang Out-of-Town Pool |

| 7:30 PM | The President departs the White House en route to New Castle, Delaware South Lawn Open Press |

| 8:25 PM | The President arrives in New Castle, Delaware Out-of-Town Pool |

President Biden has tweeted…

We got 2 tweets so far for St. Patrick’s Day Friday…

YouTube says President Biden Attends the Friends of Ireland Caucus St. Patrick’s Day Luncheon @1:00 p.m. D.C., time.

The Shamrock Presentation is scheduled for 5:00 p.m. D.C., time.

When the post was posted for Thursday, President Biden had tweeted 2 times. He added 6 tweets giving him a Thursday Tweeting Total of 8 tweets and 0 retweets.

Remarks on lowering prescription drug cost from Vegas (03/15/2023):

President Biden: Look, I’m a capitalist. I want — if you can go out and make a lot of money, go make the money. Just pay your fair share. Just — just your fair share. (Applause.) No, for real. I have no problems with a company making reasonable profits, but, my Lord, not on the backs of working families and seniors. And this is really — when it gets down to it, it’s about fairness — fairness and decency and providing people with some dignity.

I’m not gonna transcribe the 1 minute and 1 second campaign ad. It’s a campaign pitch.

From the White House.gov/The Record…

Lowering Costs of Families’ Everyday Expenses

The Inflation Reduction Act is a historic legislative achievement that lowers costs for families, combats the climate crisis, reduces the deficit, and finally makes the largest corporations pay their fair share. For the first time, Medicare is able to negotiate the price of certain high-cost drugs, a month’s supply of insulin for seniors is capped at $35, Medicare beneficiaries pay $0 out of pocket for recommended adult vaccines, and seniors’ out of pocket expenses at the pharmacy will be capped at $2,000 a year. And thanks to the President’s actions, including a historic release from the Strategic Petroleum Reserve, gas prices are down more than $1.60 from their summer 2022 peak.

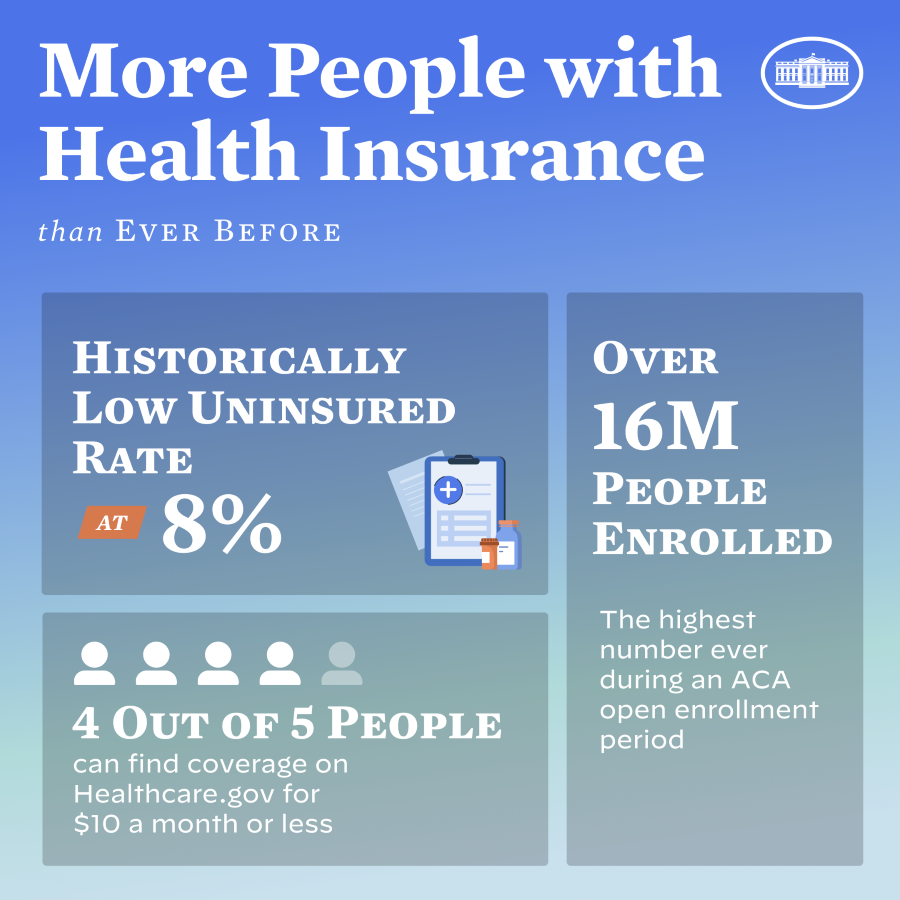

More People with Health Insurance Than Ever Before

President Biden took action to lower the cost of health care for millions of Americans. Right now, four out of five people who sign up for health insurance through the Affordable Care Act can find health care coverage for $10 a month or less and millions of Americans on Obamacare are saving an average of $800 a year. Since he took office, there has been a combined 50 percent increase in enrollment in states that use HealthCare.gov and the nation’s uninsured rate is historically low at 8 percent. Over 16 million Americans signed up for quality, affordable health coverage, the highest number ever produced in an open enrollment period.

The Presidential 184 page searchable PDF Budget can be found here.

DEPARTMENT OF HEALTH AND HUMAN SERVICES

The Department of Health and Human Services (HHS) is responsible for protecting the health

and well-being of Americans through its research, public health, and social services programs.

The President’s 2024 Budget for HHS: expands access to quality, affordable healthcare while

lowering costs; dramatically improves access to early care and learning; advances the Cancer

Moonshot; transforms behavioral healthcare; prepares for future pandemics; bolsters maternal

health; advances health equity; transforms child welfare; combats hunger and improves nutrition

and food safety; and supports rural health.The Budget requests $144 billion in discretionary budget authority for 2024, a $14.8 billion

Presidential Budget PDF pg. 80. Released 03/09/2023.

or 11.5-percent increase from the 2023 enacted level, excluding Contract Support Costs

and Indian Self-Determination and Education Assistance Act of 1975 Section 105(l) lease

amounts requested for the Indian Health Service (IHS), which the Budget proposes to shift from

discretionary to mandatory funding

Authors note: Healthcare appears in the PDF 83 times. I showed the 45th time it appears as it had the clearest dollar amount.

Remarks on lowering prescription drug cost from Vegas (03/15/2023):

President Biden: And the one thing I want you to know about the Affordable Care Act is that — the way for people who have pre-existing conditions to get healthcare. If you have a pre-existing condition and you can’t afford your healthcare — private plans, you do not get coverage anywhere. And this is the only outfit — if, in fact, you do away with the Affordable Care Act — if you have — if you have a pre-existing condition, you don’t get coverage otherwise. If MAGA Republicans had their way, as many as 100 million people with pre-existing conditions would lose their protection. That’s a fact. And, folks, look, the Affordable Health Care Act is also a means by which millions of hardworking Americans have access to preventative care like cancer screenings. MAGA Republicans put that at risk as well. And nearly 40 million Americans would be in danger of losing coverage completely if they were to succeed.

Reuters: Sanofi SA (SASY.PA) said on Thursday it will cut U.S. list prices for its most-prescribed insulin product, Lantus, by 78% starting next year after similar moves by rivals Novo Nordisk (NOVOb.CO) and Eli Lilly and Co (LLY.N). The French drugmaker will also extend its $35 out-of-pocket pricing program to all patients with commercial insurance using Lantus.

Sanofi.com says:

Sanofi cuts U.S. list price of Lantus®, its most-prescribed insulin, by 78% and caps out-of-pocket Lantus costs at $35 for all patients with commercial insurance

Paris, March 16, 2023. Sanofi announces that it will cut the list price of Lantus (insulin glargine injection) 100 Units/mL, its most widely prescribed insulin in the U.S., by 78 percent. The company also will establish a $35 cap on out-of-pocket costs for Lantus for all patients with commercial insurance, underscoring its longstanding commitment to offer affordable access to medicines.

These moves, which go into effect January 1, 2024, will come in addition to decisions taken in June 2022 to lower diabetes medicines costs: the launch of an unbranded Lantus biologic at -60% versus Lantus list price, and a cap on out-of-pocket costs on insulin to $35 for all people without insurance. With all those decisions, now Sanofi’s suite of savings programs ensures that no patient will pay more than $35 for a monthly supply of Lantus. Finally, Sanofi will also cut the list price of its short-acting Apidra (insulin glulisine injection) 100 Units/mL by 70%.

Olivier Bogillot

Head, U.S. General Medicines, Sanofi

“Sanofi believes that no one should struggle to pay for their insulin and we are proud of our continued actions to improve access and affordability for millions of patients for many years. We launched our unbranded biologic for Lantus at 60 percent less than the Lantus list price in June 2022 but, despite this pioneering low-price approach, the health system was unable to take advantage of it due to its inherent structural challenges. We are pleased to see others join our efforts to help patients as we now accelerate the transformation of the U.S. insulin market. Our decision to cut the list price of our lead insulin needs to be coupled with broader change to the overall system to actually drive savings for patients at the pharmacy counter.”Sanofi Savings Programs

Sanofi will continue to provide different programs to ensure access and affordability to patients depending on their coverage situations and will continue to monitor policy and market changes. Our suite of innovative programs includes:

Sanofi.com. 03/16/2023.

- 100% of commercially insured people are eligible for Sanofi’s copay assistance programs, regardless of income or insurance plan design, which, in 2022 limited out-of-pocket expenses for a majority of participating patients to $15 or less for their diabetes medicines for a 30-day supply.

- 100% of uninsured people are eligible for the Insulins Valyou Savings Program – regardless of income level – enabling them to buy one or multiple Sanofi insulins at $35 for a 30-day supply. The Soliqua (insulin glargine and lixisenatide) injection 100 Units/mL and 33 mcg/mL cash offer also allows uninsured people to pay as little as $99 per box of pens, for up to two boxes of pens for a 30-day supply.

We also provide free medications to qualified low- and middle-income patients the Sanofi Patient Connection program. Some people facing an unexpected financial hardship may be eligible for a one-time, immediate month’s supply of their Sanofi medicine as they wait for their application to process.

- Beginning in 2023, Sanofi insulins and Soliqua are included under the Inflation Reduction Act, where covered on Medicare formulary, which provides insulin savings, capping monthly cost at $35 for Seniors who have Medicare Part D. This ensures a predictable, stable co-pay, regardless of phase including the donut hole.

- Prior to the Inflation Reduction Act, Sanofi voluntarily participated in part of the Centers for Medicare and Medicaid Services’ (CMS) Senior Savings Model which allowed patients enrolled in participating Part D plans to pay a $35 or less co-pay for each 30-day prescription of a Sanofi insulin throughout the year.

Every patient has unique circumstances, and Sanofi has live support specialists who can be reached at (855) 984-6302 to answer individual patient’s questions and navigate their unique situation to find the best resources and programs to help lower their out-of-pocket costs.

Sanofi.com. 03/16/2023.

Learn more about Sanofi’s transparent approach to pricing in our 2023 Pricing Principles Report.

President Biden issued the following statement:

As of this afternoon, all three of the leading insulin producers in America have agreed to substantially reduce their prices, following my calls to expand my $35 cap for seniors to all Americans. Sanofi is the latest company to recognize that charging hundreds of dollars for insulin that costs $10 to produce is just wrong, especially when the lives of so many children, parents, and grandparents depend on it.

My administration is working every day to bring working people and families more breathing room, and we won’t stop. Congress should still pass legislation to ensure everybody can get insulin for no more than $35 per month, along with a Junk Fee Prevention Act, and legislation to make childcare more affordable and accessible.

What Congress should not do is repeal laws like the Inflation Reduction Act, which would represent one of the biggest Medicare benefit cuts in history and raise costs for prescription drugs, health coverage, and home energy—all to give billionaires a tax cut.

Where Congress won’t work with me, I will continue to speak out and act on my own, just as I have to give millions of families life-changing breathing room on insulin costs. After the strongest two years of job growth and new small business applications in history, and with real progress against the inflation affecting countries around the world, I am more optimistic than ever that America’s best days are ahead.

White House.gov. 03/16/2023.

This is an Open Thread.

Rare Update:

President Biden added 1 more tweet before post time; my twitter feed sometimes refuses to refresh. My bad for not manually doing so before the post posted.

His full statement:

This week, we took decisive action to stabilize the banking system without putting taxpayer dollars at risk. That action was necessary to protect jobs and small businesses, and no losses will be borne by the taxpayers. Our banking system is more resilient and stable today because of the actions we took. On Monday morning, I told the American people and American businesses that they should feel confident that their deposits will be there if and when they need them. That continues to be the case.

I also said that I’m firmly committed to accountability for those responsible for this mess. No one is above the law – and strengthening accountability is an important deterrent to prevent mismanagement in the future. The law limits the administration’s authority to hold executives responsible. When banks fail due to mismanagement and excessive risk taking, it should be easier for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again. Congress must act to impose tougher penalties for senior bank executives whose mismanagement contributed to their institutions failing.

White House.gov. 03/17/2023.

The White House posted the following fact-sheet; President Biden Urges Congressional Action to Strengthen Accountability for Senior Bank Executives

As the President said on Sunday when his administration took steps to stabilize the banking system, he is firmly committed to accountability for those responsible. Already, key executives that ran Silicon Valley Bank and Signature Bank – the two banks now under Federal Deposit Insurance Corporation (FDIC) receivership – have been removed, and investors in these two banks will take losses. The FDIC, the Securities and Exchange Commission, and the Department of Justice have regulatory authority to investigate the circumstances leading up to these banks entering receivership, and to take action against the management of these banks as appropriate.

But the President believes Congress can and should do more to hold senior bank executives accountable. Congress must take action to strengthen the ability of the federal government to hold senior management accountable when their banks fail and enter FDIC receivership. Specifically, when banks fail because of mismanagement and excessive risk taking, it should be easier for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again.

The President is calling on Congress to:

White House.gov. 03/17/2023.

Expand the FDIC’s authority to claw back compensation – including gains from stock sales – from executives at failed banks like Silicon Valley Bank and Signature Bank

The CEO of Silicon Valley Bank reportedly sold more than $3 million worth of shares just days before the bank entered FDIC receivership. The President urges Congress to expand the FDIC’s authorities to expressly cover cases like this.

Under current law, the FDIC has limited ability to claw back any compensation or gains from share sales that senior executives at Silicon Valley Bank or Signature Bank may have received shortly before their banks entered FDIC receivership. That is because the FDIC only has clawback authority under the Dodd-Frank Act’s special resolution authority, which applies to the very largest financial institutions. That authority should be extended to cover a broader set of large banks – including banks the size of Silicon Valley Bank and Signature Bank.

White House.gov. 03/17/2023.

Strengthen the FDIC’s authority to bar executives from holding jobs in the banking industry when their banks enter receivership

Under existing law, the FDIC can bar executives from holding jobs at other banks if they engage in “willful or continuing disregard for the safety and soundness” of their bank. Congress should strengthen this tool by lowering the legal standard for imposing this prohibition when a bank is put into FDIC receivership. The President believes that if you’re responsible for the failure of one bank, you shouldn’t be able to just turn around and lead another.

White House.gov. 03/17/2023.

Expand the FDIC’s authority to bring fines against executives of failed banks

Under current law, the FDIC may seek monetary penalties from bank executives who “recklessly” engage in a pattern of “unsafe or unsound” practices, regardless of whether that bank enters receivership. To help the agency fully address executive misconduct, Congress should expand the FDIC’s authority to seek fines from negligent executives of failed banks when their actions contribute to the failure of their firms.

The President is eager to work with Congress to strengthen accountability in these three areas – and others that Members of Congress identify. As the President has said, in his administration, no one is above the law.

White House.gov. 03/17/2023.

2 Trackbacks / Pingbacks

Comments are closed.