It’s Wednesday…

President Biden’s public schedule for 07/19/2023:

| 10:00 AM | In-Town Pool Call Time In-Town Pool |

| 12:15 PMOfficial Schedule | The President receives the Presidential Daily Briefing; The Vice President attends Oval Office Closed Press |

| 1:00 PM Press Briefing | Press Briefing by Press Secretary Karine Jean-Pierre James S. Brady Press Briefing Room |

| 3:00 PM Meeting | The President convenes a meeting of his Competition Council to announce new actions by his Administration to increase competition in the American economy, lower prices for consumers, and help entrepreneurs and small businesses thrive—a key pillar of Bidenomics State Dining Room In-House Pool Spray |

| 6:00 PM Picnic | The President and The First Lady host the White House Congressional Picnic; The Vice President attends by South Lawn Open Press |

Press briefing:

From the White House…

Biden-Harris Administration Announces New Initiatives to Lower Food, Rental Housing, and Other Costs and Updated Guidance Regarding Enforcement of Antitrust Laws in the Modern Economy

Promoting competition to lower costs and support small businesses and entrepreneurs is a central part of Bidenomics. When President Biden took office, four decades of misguided economic philosophy had led to a pull back from robust government action to promote competition, and concentration had increased in more than 75% of U.S industries. One estimate found that higher prices and lower wages caused by lack of competition was costing the median American household as much as $5,000 annually.

To turn the tide, almost exactly two years ago, President Biden signed a landmark Executive Order establishing the White House Competition Council and directing a “whole of government” approach to promoting competition. Today, at its fifth meeting since the Order, agencies represented on the White House Competition Council took three new actions to promote competition and lower costs:

White House.gov. 07/19/2023.

- Lowering food prices and promoting competition in agriculture: Today, the Department of Agriculture (USDA) launched an historic enforcement partnership with over two dozen bipartisan State Attorneys General to crack down on price-gouging and other anticompetitive practices in food and agricultural markets. Under the Agricultural Competition Partnership, this bipartisan group will be able to harness all available legal enforcement tools—at both the state and federal level—to help lower food prices and promote competition in agricultural markets. USDA also launched the new Farmer Seed Liaison to help to give farmers a voice in the patent process. These initiatives build on actions USDA has already taken to help lower foods costs and help farmers get a fairer price for their goods, including distributing millions of dollars in grants to expand small and independent processing, and proposing rules to address anticompetitive behavior.

- Exposing rental housing junk fees to lower rental costs: Today, the Competition Council launched a new front in the Administration’s war on junk fees, taking action to address rental housing fees. This includes rental application fees that exceed the actual cost of running the background or credit check, and additional charges like so-called “convenience fees” to pay rent online. Application fees can be up to $100 or more per application and prospective renters often apply to more than one apartment, paying hundreds in application fees including for apartments that may no longer be available. Today, Zillow, Apartments.com, and AffordableHousing.com answered the President’s call to action by committing to launch new website features to show prospective renters all the fees up front—so they can comparison shop for the best deal and know what they are paying for upfront. In addition, the Department of Housing and Urban Development issued a new white paper on rental housing junk fees, including innovative policies to address them.

- Providing clarity regarding enforcement of laws prohibiting anticompetitive mergers: Today, the Department of Justice (DOJ) and the Federal Trade Commission (FTC) answered President Biden’s call to action in his Competition Executive Order by releasing their new proposed Merger Guidelines for public comment. The Guidelines seek to give the public, businesses, workers, and consumers clarity about how law enforcement agencies evaluate mergers under the antitrust laws on the books in the context of our modern economy. As the Council of Economic Advisers explains in a new issue brief, this revised guidance reflects an approach to antitrust enforcement that is informed by the best, most up-to-date economic evidence available. Robust enforcement can lower prices, raise wages, and promote innovation.

Today’s new announcements build on the dozens of actions agencies have already taken in just the two years since President Biden signed his Executive Order. Not only have agencies already delivered on a majority of the Order’s 72 initiatives, they have gone above and beyond to launch additional new initiatives, embracing the “all of government” approach and launching more than a dozen cross-cutting interagency initiatives. The Biden-Harris Administration’s actions to date include:

White House.gov. 07/19/2023.

Transportation

- President Biden signed into law the bipartisan Ocean Shipping Reform Act, which lowers costs for American retailers, farmers, and consumers. Ocean shipping prices are down more than 80% from their peak, which has contributed to the decline in inflationary pressures—with goods prices down sharply, from over 12% to 1.4%, over the past year and a half.

- Two major global shipping container suppliers abandoned a proposed merger following a DOJ investigation into whether the merger would result in higher prices, lower quality, and more fragile global supply chains.

- The national electric vehicle charging network will now have open and interoperable chargers thanks to a Department of Transportation (DOT) final rule. The rule also requires privacy protections.

- DOJ successfully sued to block a domestic alliance between two airlines that would have raised fares and limited choice.

- DOT called out airlines’ bad service and got results. Previously, none of the 10 largest U.S. airlines guaranteed meals or hotels when they caused a cancellation or significant delay and no airline guaranteed that parents can sit with their children for free. Now, thanks to DOT’s use of the bully pulpit, 9 of the 10 largest airlines guarantee hotels, 10 airlines to guarantee meals, and 3 airlines to guarantee fee-free family seating. Consumers can see what services airlines offer at FlightRights.Gov.

- DOT is pursuing an unprecedented expansion of airline passenger rights and protections. It has put out a suite of proposed rules that, if finalized as proposed, would: (1) require airlines to promptly refund airline tickets when they cancel or significantly change a flight; (2) require refunds for services not delivered (like broken Wi-Fi or delayed bags), and (3) require fees to be disclosed up-front for add-on services like checking a bag or changing or canceling a flight. DOT is also working on rules that would ban family seating junk fees and would require airlines to compensate flyers when a flight is cancelled or delayed due to the airline’s fault.

- The Surface Transportation Board (STB) has adopted a new rule to make it easier and faster for rail customers to challenge excessive railroad rates. The STB is also pursuing a rulemaking on reciprocal switching that, if finalized as proposed, would introduce more rail service options to shippers and a proposed a rule that, if finalized as proposed, would allow rail customers to more easily seek relief during service emergencies.

Food and Agriculture

- Farmers and ranchers can now anonymously report potential unfair and anticompetitive practices through FarmerFairness.gov, a new enforcement collaboration between DOJ and FTC that brings both agencies’ investigative resources and authorities to bear. This enforcement collaboration resulted in a successful settlement with major poultry processors that deceived farmers and suppressed wages.

- Thirty-one small, independent meat and poultry processors have received $171 million in USDA award funding to offer more processing capacity for farmers in 23 states, through the Meat and Poultry Processing Expansion Program (MPPEP) and Meat and Poultry Intermediary Lending Program (MPILP). These awards are part of a broader $1 billion investment to expand independent meat and poultry processing capacity across the country as part of the Biden-Harris Administration’s Action Plan for a Fairer, More Competitive, and More Resilient Meat and Poultry Supply Chain.

- USDA stood up and dedicated $500 million for the Fertilizer Production Expansion Program, which supports fertilizer production that is independent, made-in-America, innovative, sustainable, and farmer-focused.

- To protect farmers and ranchers from harmful, anti-competitive practices, USDA proposed a Packers and Stockyards Act rule that, if finalized as proposed, would prohibit discrimination, retaliation, and deception in livestock, meat, and poultry markets. USDA is also working on additional Packers and Stockyards Act rules to address unfair practices in the poultry tournament system and to clarify that a market-wide showing of harm to competition is not required to establish a violation of the Act.

- To give American consumers more accurate information about the food they consume, USDA proposed a rule that, if finalized as proposed, would allow the voluntary “Product of USA” or “Made in the USA” claim to be applied only on meat, poultry, and egg products when they are derived from animals born, raised, slaughtered and processed in the United States. Under current labeling rules, a product could be labeled “Product of USA” if it was only processed here—including when meat is raised overseas and then merely processed into cuts of meat domestically. That makes it hard or impossible for consumers to know where their food comes from and to choose to support American farmers and ranchers.

- Growers and plant breeders will have more transparency about the complex seed system through USDA’s launch of a Farmer Seed Liaison Initiative, in collaboration with the U.S. Patent and Trademark Office (USPTO). This initiative follows a landmark report published by USDA on competition problems in seed markets.

- Treasury, in consultation with DOJ and FTC, released a report on competition in the markets for beer, wine, and spirits, celebrating the vibrancy and innovativeness of the U.S. alcohol industry while proposing a series of recommendations to level the playing field for small businesses. Treasury is working on a suite of rulemakings to implement recommendations in the report.

Technology and Internet Service

- Broadband providers will soon be required to display “Broadband Nutrition Labels” for consumers—simple labels that provide basic information about the internet service offered, including costs and fees, so people can compare options more easily—thanks to a rule finalized by Federal Communications Commission (FCC).

- Tenants of office buildings and apartments can now access more options, thanks to FCC cracking down on “sweetheart deals” between landlords and internet providers that lock tenants into just one provider.

- FCC has proposed rules that, if finalized as proposed, would require cable providers to display total, “all-in” prices clearly and prominently, so consumers know what they are getting and at what price.

- FTC released a new enforcement policy on the “Right to Repair” and secured major settlements making it easier and cheaper to repair grills, motorcycles, and generators. Since the President’s Order endorsed the “Right to Repair,” Microsoft and Apple have announced voluntary changes, and Minnesota, Colorado, and New York passed new laws.

- FTC stopped a $40 billion semiconductor megamerger that would have stifled innovation.

- FTC has proposed a rule that, if finalized as proposed, would make it as easy to cancel a subscription as it was to sign up.

- FTC launched the rulemaking process for new privacy rules to crack down on harmful surveillance, data collection, and data security practices that threaten Americans’ privacy and enable companies to profit off collecting vast troves of personal data from consumers.

- The Department of Commerce announced the Biden-Harris Internet for All initiative, a $45 billion investment in high-speed internet access, which, after funding infrastructure in areas without access, will provide funding for competitors in areas where existing access is low-quality.

Labor Markets

- An estimated 30 million workers could benefit from a non-competes ban proposed by the FTC that, if finalized in its current form, could raise wages by nearly $300 billion annually. Non-compete agreements reduce workers’ mobility, thus suppressing wages and limiting opportunity.

- The Department of Labor published an interim final rule in February establishing procedures and timeframes for handling whistleblower retaliation complaints under the Criminal Antitrust Anti-Retaliation Act (CAARA).

- The Department of Labor has also partnered with the Department of Justice’s Antitrust Division to protect workers’ rights and support worker mobility and more competitive labor markets. Both the FTC and the DOJ have also agreed to share information with the National Labor Relations Board as part of efforts to protect workers from unfair labor practices.

- DOJ successfully sued to block Penguin Random House’s proposed $2.2 billion acquisition of Simon & Schuster—a victory for authors, readers, and the free exchange of ideas that also sets a landmark legal precedent that antitrust laws protect workers.

Healthcare

- President Biden signed into law the Inflation Reduction Act, which lowers the cost of prescription drugs for Medicare beneficiaries. The Department of Health and Human Services (HHS) is implementing key Medicare provisions of the Act, while also pursuing other initiatives such as continuing to advance competition from lower cost generic drugs and biosimilars.

- Hearing aids for mild-to-moderate hearing loss are now available in stores without a prescription, thanks to the Food and Drug Administration (FDA) finalizing a rule allowing over-the-counter sales. This is saving the nearly 30 million Americans with hearing loss as much as $3,000 per pair. And now, 10 months since hearing aids became available, new companies are entering the market and offering new products and features in thousands of stores across all 50 states. Many retailers are expanding both their product offerings and the number of stores that sell over-the-counter hearing aids.

- Consumers have access to new data about ownership in health care as the Administration for the first time has made ownership data on hospitals, nursing homes, hospice providers, and home health agencies publicly available. HHS has also proposed new rules that would shed light on private equity ownership of nursing homes. HHS has also proposed new requirements for hospitals to publicly post their charges in a standardized way and to strengthen oversight of noncompliant hospitals.

- The Department of Commerce (DOC) and HHS announced a joint effort to produce a whole-of-government framework for making decisions about when to exercise “march-in” authority, including when price may be a consideration.

- Consumers can now compare apples-to-apples when choosing the health plan that will work best for them because HHS finalized a rule requiring insurers to offer standardized plans on the ACA Marketplace.

- The Administration is increasing scrutiny of prescription drug patents that unduly delay competition through a joint effort launched between HHS and USPTO.

- Doctors will automatically provide patients with a copy of their prescriptions immediately after an eye exam if an update to the Eyeglass Rule proposed by the FTC is finalized as proposed.

Small Businesses

- The Biden-Harris Administration delivered more than $450 billion in emergency relief funding to over 6 million small businesses during the pandemic. During 2021 and 2022, Americans filed a record 10.5 million applications to start small business. This recovery and these record applications represent hope and optimism of entrepreneurs across the country and are bringing increased options and competition to industries across the economy.

- The Department of Defense rolled out its small business strategy that simplifies entry points for small businesses into the defense marketplace, aligns small business programs with mission priorities and increases engagement and support for small businesses in the industrial base.

- The Treasury Department has directed billions of dollars towards small businesses. Through the American Rescue Plan’s State Small Business Credit Initiative, Treasury is distributing nearly $10 billion to states, territories, and tribal governments to expand access to capital for small businesses. Through the Emergency Capital Investment Program (ECIP), Treasury has closed and funded more than $8.3 billion in investments to support the efforts of community financial institutions to provide loans, grants, and other assistance, including to small and minority-owned businesses.

- The Commerce Department’s Minority Business Development Agency (MBDA) has launched the nearly $100 million Capital Readiness Program, which will provide funding to incubators and accelerators across the country to support minority and other underserved entrepreneurs who want to start or scale their businesses in high-growth industries such as healthcare, climate resilient technology, asset management, infrastructure, and more.

- The Small Business Administration has finalized rules that will allow it to extend additional 7a licenses to nonbank lenders and community development financial institutions (CDFIs), expanding options for lending to small businesses and promoting competition among lenders.

Banking, Insurance, and Consumer Finance

- DOJ successfully sued to block the merger of two larger insurance brokerages that would have left the market with just two dominant players and could have raised costs for millions of consumers and businesses.

- A rule proposed by the Consumer Financial Protection Bureau (CFPB) would lower typical credit card late fees from approximately $30 to $8, saving consumers up to $9 billion annually if finalized as proposed. Additionally, as a result of the CFPB’s actions to address bounced check and overdraft fees, consumers will save an estimated $5.5 billion a year going forward.

- The CFPB launched a rulemaking process to make it easier and cheaper for consumers to switch banks and access credit, by allowing customers to take their financial transaction data with them to a competitor.

- The CFPB is helping to spur technological advancement in financial services through its new office, the Office of Competition and Innovation, which will help to promote competition and identify stumbling blocks for new market entrants.

- The Securities and Exchange Commission has finalized a rule that will bring more competition, transparency, and efficiency to private investments funds—an $18 trillion marketplace.

Major rental housing platforms and several states join the President’s effort to crack down on rental housing junk fees for consumers and increase transparency

Today, President Biden is announcing a new front in his crackdown on junk fees: rental housing. From repeated rental application fees to surprise “convenience fees,” millions of families incur burdensome costs in the rental application process and throughout the duration of their lease. These fees are often more than the actual cost of providing the service, or are added onto rents to cover services that renters assume are included—or that they don’t even want.

White House.gov. 07/19/2023.

Rental housing fees can be a serious burden on renters. Rental application fees can be up to $100 or more per application, and, importantly, they often exceed the actual cost of conducting the background and credit checks. Given that prospective renters often apply for multiple units over the course of their housing search, these application fees can add up to hundreds of dollars. Even after renters secure housing, they are often surprised to be charged mandatory fees on top of their rent, including “convenience fees” to pay rent online, fees for things like mail sorting and trash collection, and even so-called “January fees” charged for no clear reason at the beginning of a new calendar year. Hidden fees not only take money out of people’s pockets, they also make it more difficult to comparison shop. A prospective renter may choose one apartment over another thinking it is less expensive, only to learn that after fees and other add-ons the actual cost for their chosen apartment is much higher than they expected or can afford.

Today, the President will outline several new, concrete steps in the Administration’s effort to crack down on rental junk fees and lower costs for renters, including:

- New commitments from major rental housing platforms—Zillow, Apartments.com, and AffordableHousing.com—who have answered the President’s call for transparency and will provide consumers with total, upfront cost information on rental properties, which can be hundreds of dollars on top of the advertised rent;

- New research from the Department of Housing and Urban Development (HUD), which provides a blueprint for a nationwide effort to address rental housing junk fees; and

- Legislative action in states across the country—from Connecticut to California—who are joining the Administration in its effort to crack down on rental housing fees and protect consumers.

These announcements build on the President’s effort to tackle junk fees across industries. President Biden has repeatedly called on federal agencies, Congress, and private companies to take action to address junk fees across the economy, and ensure Americans are provided with honest, transparent pricing. These hidden fees increase the costs consumers pay: studies have found that consumers pay upward of 20 percent extra when the actual price of the product or service is not disclosed upfront. Providing consumers with the full price they can expect to pay creates competition among providers to lower costs, without relying on hidden fees. Earlier this year HUD Secretary Marcia Fudge released an open letter to housing providers and state and local governments to encourage them to adopt policies that promote greater fairness and transparency of fees specifically faced by renters.

White House.gov. 07/19/2023.

Today’s actions include:

Commitments by rental housing platforms to show total costs up front.

Each month, tens of millions of customers search online to find their next apartment or house. Today, major rental housing platforms are answering President Biden’s call for pricing transparency and announcing new steps to provide consumers with up-front information about fees in rental housing, building on recent actions by private sector leaders in other sectors, including airlines and event tickets. By providing the true costs of rent, people can make an informed decision about where to live and not be surprised by additional costs that push them over budget.

These companies are making the following announcements:

White House.gov. 07/19/2023.

- Zillow is today launching a Cost of Renting Summary on its active apartment listings, empowering the 28 million unique monthly users on its rental platform with clear information on the cost of renting. This new tool will enable renters to easily find out the total cost of renting an apartment from the outset, including all monthly costs and one-time costs, like security deposits and application fees.

- Apartments.com is announcing that this year it will launch a new calculator on its platform that will help renters determine the all-in price of a desired unit. This will include all up-front costs as well as recurring monthly rents and fees. The Apartments.com Network currently lists almost 1.5 million active availabilities across more than 385,000 properties.

- AffordableHousing.com, the nation’s largest online platform dedicated solely to affordable housing, will require owners to disclose all refundable and non-refundable fees and charges upfront in their listings. It will launch a new “Trusted Owner” badge that protects renters from being charged junk fees by identifying owners who have a history of adhering to best practices, including commitment to reasonable fee limits, no junk fees, and full fee disclosure.

New research on policy innovation to address rental fees.

Today, HUD is releasing a new research brief that provides an overview of the research on rental fees and highlights state, local, and private sector strategies to encourage transparency and fairness in the rental market, including capping or eliminating rental application fees; allowing prospective renters to provide their own screening reports; allowing a single application fee to cover multiple applications; and clearly identifying bottom-line amounts that tenants will pay for move-in and monthly rent. The brief provides a blueprint for how everyone from local government to landlords can do better for renters.

Recent state actions to address the hidden and unfair fees.

In March, the White House convened hundreds of state legislative leaders, and released a resource entitled, “Guide for States: Cracking Down on Junk Fees to Lower Costs for Consumers.” Since the President drew attention to the pervasive issue of junk fees throughout the economy, a number of states have already gotten to work to crack down on rental housing fees, including:

White House.gov. 07/19/2023.

- Colorado. Enacted House Bill 1099, which allows prospective renters to reuse a rental application for up to 30 days without paying additional fees; and House Bill 1095, which limits fees to tenants when landlords fail to provide a nonrenewal notice that disguise fees as “rent,” and limits the amount a landlord can mark up a tenant for third-party services.

- Rhode Island. Enacted House Bill 6087 to limit rental application fees beyond the actual cost of obtaining a background check or credit report, if the prospective tenant does not provide their own report.

- Minnesota. Enacted Senate File 2909, which includes a requirement for landlords to clearly display the total monthly payment and all nonoptional fees on the first page of the lease agreement and in all advertisements.

- Connecticut. Enacted Senate Bill 998 to prohibit a landlord from requiring a fee for processing, reviewing, or accepting a rental application, and set a cap of $50 on the amount that can be charged for tenant screening reports. The law also prohibits move-in and move-out fees, and certain fee-related lease provisions, including certain late fees related to utility payments.

- Maine. Enacted Legislative Document 691 to prohibit a landlord from charging a fee to submit a rental application that exceeds the actual cost of a background check, a credit check, or another screening process. The law also prohibits a landlord from charging more than one screening fee in any 12-month period.

- Montana. Senate passed Senate Bill 320 to require landlords to refund application fees to unsuccessful rental applicants except any portion of the fee used to cover costs related to reviewing the application, including conducting a background check. Landlords may only charge candidates for the actual cost of obtaining a background check or credit report.

- California. Senate passed Senate Bill 611 to require the mandatory disclosure of monthly rent rates, including disclosure of a range of payments, fees, deposits, or charges, and to prohibit certain fees from being charged.

Earlier this year, the Consumer Financial Protection Bureau and the Federal Trade Commission, both independent agencies, requested information on tenant screening processes, including how landlords and property managers set application and screening fees, which will help inform enforcement and policy actions under each agency’s jurisdiction. The CFPB has noted that background checks too often include inaccurate or misleading information and risk scores that lack independent validation of their reliability.

Today’s announcements build on the Biden-Harris Administration’s ongoing efforts to support renters, including through the release of a first-of-its-kind Blueprint for a Renters Bill of Rights and a Housing Supply Action Plan, focused on boosting the supply of affordable housing—including rental housing. Reducing housing costs is central to Bidenomics, and recent data show that inflation in rental housing is abating. Moreover, experts predict that roughly 1 million new apartments will be built this year, increasing supply that will further increase affordability. The actions announced today will help renters understand these fees and the full price they can expect to pay, and create additional competition housing providers to reduce reliance on hidden fees.

In the coming months, the Biden-Harris Administration will work with Congress, state leaders, and the private sector to address rental junk fees and build a fairer rental housing market. On July 26, the Senate Committee on Banking, Housing, and Urban Affairs will host its first-ever hearing on junk fees, including in the rental housing market.

White House.gov. 07/19/2023.

The meeting of his Competition Council:

What’s New Tweet

From Tuesday…

The first text bubble hidden from view is from Connor who says; Lots of road construction in Tuscon, love the infrastructure deal.

I can’t help it, every time he tweets out his burner phone number I think…

Small Businesses Tweets

From Tuesday…

From SBA.gov:

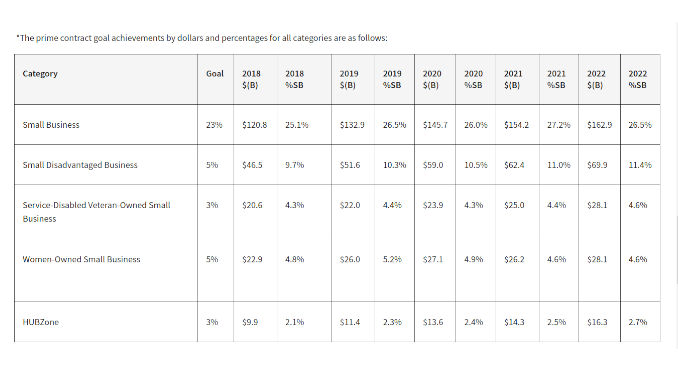

Today, Administrator Isabella Casillas Guzman announced that the Biden-Harris Administration exceeded its small business contracting goal of 23% in fiscal year (FY) 2022, awarding an all-time high 26.5% of federal contract dollars to small businesses. This historic level amounts to a $162.9 billion investment in the small business economy – an $8.7 billion increase from the previous fiscal year. Ten federal agencies earned an “A+” for their agencies’ achievements in small business contracting, and an additional ten agencies received an “A” grade. The federal government, overall, earned an “A” on this year’s government-wide scorecard.

“Through President Biden’s Investing in America agenda, we have championed initiatives to fuel our nation’s historic economic growth while reducing barriers and ensuring fair competition in federal contracting,” said Administrator Guzman. “The Biden Administration continues to raise the bar, reaching a record high level of contract spending with small businesses, supporting over one million good-paying jobs in manufacturing, construction, research & development, and other vital industries.”

SBA plays a crucial role in setting contracting goals for each agency and collaborates closely with government buyers to emphasize the prioritization of small businesses in the procurement process. Individual agency scorecards with a detailed explanation of the methodology are available at SBA.gov.

Highlights of the overall performance of the federal government include:

SBA.gov. 07/18/2023.

- For the second consecutive year, Small Disadvantaged Business (SDB) spending exceeded its 11% goal. The noteworthy achievement reflects President Biden’s unwavering commitment to meeting an ambitious SDB contracting goal.

- Service-disabled Veteran-owned small business spending has exceeded its 3% goal, reaching 4.6%. This achievement translates to $28.1 billion in procurement, reflecting a $3 billion spending increase compared to the previous year.

- Historically Underutilized Business Zone (HUBZone) small businesses were granted a record-breaking $16.3 billion in federal contract awards, marking the highest amount ever awarded to this category in the program’s history. Despite not meeting the 3% statutory goal, the federal government made significant strides in supporting and empowering HUBZone small businesses.

- Women-owned Small Businesses (WOSB) received more than $26 billion for the fourth straight year, accounting for 4.6% of the Fiscal Year 2022 total eligible dollars, slightly below the 5% target. The overall dollars granted to WOSBs increased from $26.2 billion in Fiscal Year 2021 to $28.1 billion in Fiscal Year 2022. Moreover, the funds set aside specifically for WOSB firms amounted to $1.56 billion in Fiscal Year 2022, showing a remarkable 17% surge. This growth followed the expansion of certified WOSB firms from approximately 1,000 to nearly 6,000 and the NAICS codes in which women-owned businesses can receive set-aside awards. With over 92% of federal spending covered by NAICS codes eligible for WOSB set-aside awards, the SBA remains dedicated to collaborating with contracting agencies, actively pursuing future changes to achieve the 5% WOSB goal.

- The federal government achieved its small business subcontracting goals, awarding 30.9%, or $79.1 billion, to small business subcontractors.

- In Fiscal Year 2022, although there was a significant increase in small business awards, the number of small businesses receiving prime contracts with the federal government continued a multi-year trend of decreases in small-business vendors, spanning a decade.

Expanding Access to Federal Contracting:

The Small Business Administration, under the Biden-Harris Administration, has made it a top priority to expand access to federal contracting. The SBA, under Administrator Guzman’s leadership, has made several strategic and targeted changes to ensure small businesses, particularly those in underserved communities, are empowered to find and take advantage of opportunities presented by President Biden’s signature legislation, including the historic Bipartisan Infrastructure Law, CHIPS and Science Act, and more. Actions include:

SBA.gov. 07/18/2023.

- Releasing new guidance, “Creating a More Diverse and Resilient Federal Marketplace through Increased Participation of New and Recent Entrants.” This executive action includes several new initiatives for encouraging new entrants to the federal contracting space, including a Supplier Base Dashboard to track an agency’s mix of new entrants, recent entrants, and established vendors.

- Announcing several reforms in small business contracting, including directing all agencies to include progress toward achievement of each of the socioeconomic small business goals as evaluation criteria in all performance plans for Senior Executive Service (SES) managers that oversee the acquisition workforce or agency programs supported by contractors.

- Revising an agreement with federal agencies to promote maximum utilization of 8(a) certified SDBs to ensure equitable access to contracting opportunities.

- Updating NAICS codes eligible for WOSB set-aside contracts expanded from 444 to 759, representing a 70% increase.

- Activating ChallengeHer, a government contracting education initiative to help women-owned small business gain access to federal contracts and encourage participation in the SBA’s WOSB program alongside partners from Women Impacting Public Policy (WIPP) and American Express (AMEX).

- Creating a new HUBZone map that updates designations and census tract boundaries resulting from the 2020 Census.

- Implementing a new certification system for SDVOSBs as part of the migration of Veteran-owned business certification from the Department of Veterans Affairs (VA) to SBA.

1. FY 2019-22, in accordance with federal law, SBA provided double credit, for Scorecard purposes only, for prime contract awards in disaster areas that were awarded as a local area set aside and a small business or other socioeconomic set aside when the vendor state is the same as the place of performance (15 USC § 644(f)), and for awards to small businesses in Puerto Rico or covered territories (15 USC § 644(x)(1)). SBA also included in the calculation of government-wide achievements the Department of Energy first-tier subcontracts required to be included by section 318 of the Consolidated Appropriations Act of 2014 (“CAA”), Public Law 113-76.

SBA.gov. 07/18/2023.

Small Business Federal Procurement Scorecard Overview:

The annual Procurement Scorecard serves as a vital assessment tool, gauging the effectiveness of federal agencies in meeting their small business and socioeconomic prime contracting and subcontracting goals. This comprehensive Scorecard not only offers accurate and transparent contracting data but also provides detailed reports on agency-specific progress.

Working in collaboration with federal agencies, the Small Business Administration annually assists in establishing individual prime and subcontracting goals. Moreover, the SBA ensures that the federal government, as a whole, meets or surpasses the government-wide statutory goals mandated in 15(g)(1) of the Small Business Act for each category.

To maintain the quality and accuracy of contracting data, every federal agency takes responsibility for its own data. Simultaneously, the SBA conducts supplementary analyses to identify potential data anomalies. Working alongside federal agency procurement staff, the SBA provides crucial analyses and tools to facilitate data review, enhance procurement systems, and conduct training to improve accuracy. This collaborative effort ultimately strengthens the federal government’s commitment to small business participation and success in government contracts.

SBA.gov. 07/18/2023.

His full statement on the SBA.gov news:

I came to office determined to build the economy from the middle out and bottom up, not the top down – that’s Bidenomics – and supporting small business has been central to the progress we’ve made. My first two years saw the most Americans applying to start small businesses of any on record. Today’s report from the Small Business Administration shows that we’ve also made progress leveling the playing field in federal contracts, with a record $163 billion going to small businesses. Just in the last fiscal year, our policies have supported one million jobs in small businesses.

This report also shows progress in increasing the share of federal contracts going to small disadvantaged businesses. Vice President Harris and I are committed to ensuring that federal investments build wealth and opportunity for underserved entrepreneurs and small business owners in every community across the country. Small businesses are the engines of our economy and the heart and soul of our communities, and investing in our small business entrepreneurs means investing in competition and job creation.

White House.gov. 07/18/2023.

“Bidenomics” =’s American Rescue Plan. Bipartisan Infrastructure Act. Inflation Reduction Act. CHIPS and Science Act.

Internet For All Tweet

From Tuesday…

Internet For All.gov is a resource site with information on the different programs available to receive lower cost internet.

Freedom to Vote Act Tweet

From Tuesday…

Senator Amy Klobuchar (D-MN) tweeted…

Senator Klobuchar (D-MN) issued the following press release:

U.S. Senator Amy Klobuchar (D-MN), Chairwoman of the Committee on Rules and Administration with oversight over federal elections and campaign finance law, joined with her colleagues to introduce the Freedom to Vote Act, legislation to improve access to the ballot for Americans, advance commonsense federal election standards and campaign finance reforms, and protect our democracy. The Freedom to Vote Act has received the full support of Senate Democrats for the second year in a row.

The legislation reflects feedback from state and local election officials to ensure the people responsible for implementing reforms are able to do so effectively. It also elevates the voices of American voters by ending partisan gerrymandering. And it will help eliminate the undue influence of secret money in our elections.

Klobuchar.Senate.gov. 07/18/2023.

I have omitted the quotes from Senators to save space…

The Bill:

This bill, which received the full support of the Democratic Caucus when it was considered on the Senate floor in January 2022, includes three sections, each intended to protect the right to vote and strengthen our democracy. Bill text can be found here.

Klobuchar.Senate.gov. 07/18/2023.

I. Voter Access and Election Administration

This section includes provisions to improve voter access by implementing reliable state best practices for voter registration and election administration to ensure all Americans can easily exercise their freedom to vote regardless of where they live.

Klobuchar.Senate.gov. 07/18/2023.

- Automatic Voter Registration and Online Voter Registration: Enacts an automatic voter registration system for each state through the state’s motor vehicle agency and ensures voters in all states have access to online voter registration.

- Election Day Holiday: Makes Election Day a public holiday.

- Uniform Early Voting: Ensures voters have access to at least two weeks of early voting for federal elections, including two weekends, while accommodating small election jurisdictions and vote-by-mail jurisdictions.

- Same Day Voter Registration: Ensures every state offers same day registration at a limited number of locations for the 2024 elections and at all polling locations by 2026, allowing election officials, especially in rural areas, time to implement the new requirements.

- Federal Minimum Standards on Vote by Mail and Drop Boxes: Ensures all voters can request a mail-in ballot, improves the delivery of election mail, and puts in place minimum standards to ensure drop boxes are available and accessible to all voters.

- Strengthens Voter List Maintenance Standards: Requires that the removal of voters from the rolls is done on the basis of reliable and objective evidence and prohibits the use of returned mail sent by third parties to remove voters.

- Counting of Provisional Ballots: Requires provisional ballots to count for all eligible races within a county, regardless of the precinct they were cast in.

- Standards for Voter Identification: Promotes voter confidence and access by requiring a uniform national standard for states that require identification for in-person voting, and allowing voters to present a broad set of identification cards and documents in hard copy and digital form. States that do not have a voter identification requirement would not be required to make any changes.

- Voting Rights Restoration for Returning Citizens: Restores the right to vote in federal elections for people who have served their time for felony convictions after they are released from prison.

- Expanded Voting Access Protections for the Disabled, Native Americans, Military, Overseas Voters, and Underserved Communities: Includes targeted protections to promote accessible voting to communities facing unique challenges.

II. Election Integrity

This section includes measures to promote confidence in elections, stop partisan election subversion, and protect against election interference, both foreign and domestic.

Klobuchar.Senate.gov. 07/18/2023.

- Preventing State Election Subversion: Establishes federal protections to insulate nonpartisan state and local officials who administer federal elections from undue partisan interference or control.

- Protection of Election Records, Election Infrastructure, and Ballot Tabulation: Strengthens protections for federal election records and election infrastructure in order to protect the integrity and security of ballots and voting systems.

- Voter-Verified Paper Ballots, Reliable Audits, and Voting System Upgrades: Requires states to use voting systems that use paper ballots that can be verified by voters and to implement reliable post-election audits. Also provides grants for states to purchase new and more secure voting systems and make cybersecurity improvements.

- Non-Partisan Election Official Recruitment and Training: Tasks the Election Assistance Commission with developing model training programs to recruit a new generation of election workers and provides dedicated grants for training and recruitment.

- Comprehensive Voting System Security Protections: Puts in place election vendor cybersecurity standards, including standards for manufacturing and assembling voting machines, among other key security measures.

- Establishing Duty to Report Foreign Election Interference: Creates a reporting requirement for federal campaigns to disclose certain foreign contacts.

III. Civic Participation and Empowerment

This section includes provisions to prevent partisan manipulation of the redistricting process, establishes uniform disclosure standards for money in politics, and empowers states to make critical investments in their election systems.

Klobuchar.Senate.gov. 07/18/2023.

- Non-Partisan Redistricting Reform and Banning Partisan Gerrymandering: Requires states to abide by specific criteria for congressional redistricting and makes judicial remedies available for states’ failure to comply. Allows states to choose how to develop redistricting plans, including the option of having an independent redistricting commission.

- Combatting Secret Money and Election Interference (DISCLOSE Act and Honest Ads Act): Requires super PACs, 501(c)(4) groups, and other organizations spending money in elections to disclose donors and shuts down the use of transfers between organizations to cloak the identity of contributors. Ensures that political ads sold online have the same transparency and disclosure requirements as ads sold on TV, radio, and satellite.

- State Election Assistance and Innovation Fund: Establishes a self-sustaining fund to finance critical investments in state-led innovations for our democracy and election infrastructure. The fund is financed through an additional assessment paid on federal fines, penalties, and settlements for certain tax crimes and corporate malfeasance. States would be allotted an annual distribution for eligible democracy and election-related investments. States could select to access their full distribution or a partial distribution, or roll over their distribution for future use.

- Nonpartisan Oversight of Federal Election Law: Improves the ability of the Federal Election Commission to carry out oversight and enforcement responsibilities.

- Stopping Illicit Super PAC Coordination: Creates “coordinated spender” category to ensure single-candidate super PACs do not operate as arms of campaigns.

As Chairwoman of the Rules Committee, Klobuchar has been a leading advocate for protecting the right to vote, increasing access to the ballot, and safeguarding election workers and the electoral process.

In April 2023, Klobuchar reintroduced the Election Worker Protection Act, comprehensive legislation to address threats to election workers, with Senator Dick Durbin (D-IL) and 23 of their colleagues.

In March 2023, Klobuchar held a Rules Committee hearing on election administration, including the impact of increasing threats directed at election officials on the ability of states and local governments to administer elections.

Last month, Klobuchar held a Rules Committee oversight hearing over the Election Assistance Commission (EAC), the agency tasked with helping states administer federal elections.

In May 2023, Klobuchar and colleagues reintroduced the Protecting Election Administration from Interference Act to expand protections against election interference during the ballot counting and certification processes. In the same month, she introduced the Support our Election Workers Act which would require the EAC to distribute grants to states to provide increased pay for election workers, including people serving as poll workers and election officials.

Klobuchar.Senate.gov. 07/18/2023.

PACT Act Tweet

From Tuesday…

The VA.gov link shared by President Biden is a resource site with a FAQ and links to apply for VA benefits.

Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics Act of 2022 (PACT Act, 08/10/2022).

Student Debt Relief Tweet

From Tuesday…

Event Brite.com said this about the public hearing held on Tuesday:

We will hold a virtual public hearing for interested parties to discuss the rulemaking agenda from 10 a.m. to noon and 1 p.m. to 4 p.m., Eastern time on July 18, 2023. Further information on the public hearing is available at: https://www2.ed.gov/policy/highered/reg/hearulemaking/2023/index.html.

Individuals who would like to present comments at the public hearing must register by sending an email message to negreghearing@ed.gov no later than noon, Eastern time on the business day prior to the public hearing. The message should include the name of the presenter, the general topic(s) the individual would like to address, and one or more dates and times during which the individual would be available to speak. We will attempt to accommodate each speaker’s preference, but if we are unable to do so, we will select speakers on a first-come, first-served basis based on the date and time we received the message. We will limit each participant to four minutes.

The Department will notify speakers of the time slot reserved for them and provide information on how to log in to the hearing as a speaker. An individual may make only one presentation at the public hearing. If we receive more registrations than we can accommodate, we reserve the right to reject or cancel the registration of an entity or individual affiliated with an entity or individual that is already scheduled to present comments to ensure that a broad range of entities and individuals are able to present. Registration is required to view the virtual public hearing. We will post links for attendees who wish to observe on our website at https://www2.ed.gov/policy/highered/reg/hearulemaking/2023/index.html. The Department will also post transcripts of the hearing on that site.

Event Brite.com.

There is currently no recording of the event available.

Secretary of Education Miguel Cardona tweeted…

The full press release:

Last week, the Department of Education began notifying impacted borrowers they were eligible for automatic loan relief

The U.S. Department of Education (Department) today released state-by-state data on the number of borrowers who are eligible for automatic loan relief under fixes to Income-Driven Repayment (IDR) plans implemented by the Biden-Harris Administration to ensure all borrowers have an accurate count of the number of monthly payments that qualify toward forgiveness. On Friday, the Department started notifying 804,000 borrowers who have a total of $39 billion in Federal student loans that will be automatically discharged in the coming weeks. Today’s data show how many borrowers and the total amount that is eligible for relief in each state and territory as a result of this action. Since the beginning of the Biden-Harris Administration, the Department has approved more than $116 billion in student loan forgiveness for more than 3.4 million borrowers.

The discharges announced on Friday are part of the Department’s commitment to address historical failures in the administration of the Federal student loan program in which qualifying payments made under IDR plans that should have moved borrowers closer to forgiveness were not accurately accounted for. Borrowers are eligible for forgiveness if they have accumulated the equivalent of either 20 or 25 years of qualifying months depending on their loan type and IDR plan. Friday’s action is a result of the Biden-Harris Administration’s implementation of the payment count adjustment announced in April 2022.

Ed.gov. 07/18/2023.

| Borrowers Approved for IDR Discharge under the Account Adjustment by Location | ||

| State | Borrower Count | Debt Eligible for Discharge (in millions) |

| Alabama | 12,720 | $553.90 |

| Alaska | 970 | $51.40 |

| Arizona | 20,530 | $1,030.40 |

| Arkansas | 6,940 | $342.60 |

| California | 61,890 | $2,958.80 |

| Colorado | 15,010 | $805.40 |

| Connecticut | 7,230 | $309.90 |

| Delaware | 2,430 | $113.10 |

| District of Columbia | 2,230 | $130.20 |

| Florida | 56,930 | $3,036.80 |

| Georgia | 38,590 | $2,130.40 |

| Hawaii | 1,690 | $90.20 |

| Idaho | 5,720 | $252.90 |

| Illinois | 28,450 | $1,316.00 |

| Indiana | 19,470 | $932.80 |

| Iowa | 10,730 | $465.10 |

| Kansas | 8,410 | $424.50 |

| Kentucky | 11,180 | $447.70 |

| Louisiana | 15,190 | $824.70 |

| Maine | 4,790 | $212.50 |

| Maryland | 16,750 | $918.30 |

| Massachusetts | 12,530 | $592.00 |

| Michigan | 26,980 | $1,267.30 |

| Minnesota | 13,610 | $645.20 |

| Mississippi | 9,480 | $450.90 |

| Missouri | 18,800 | $956.80 |

| Montana | 3,700 | $185.20 |

| Nebraska | 5,700 | $268.90 |

| Nevada | 6,820 | $330.00 |

| New Hampshire | 3,090 | $143.80 |

| New Jersey | 17,290 | $788.00 |

| New Mexico | 5,410 | $260.30 |

| New York | 42,070 | $1,924.10 |

| North Carolina | 24,870 | $1,135.10 |

| North Dakota | 2,110 | $100.60 |

| Ohio | 37,070 | $1,736.90 |

| Oklahoma | 11,530 | $548.40 |

| Oregon | 11,780 | $572.80 |

| Pennsylvania | 29,840 | $1,343.50 |

| Rhode Island | 2,580 | $109.70 |

| South Carolina | 16,330 | $855.20 |

| South Dakota | 3,030 | $147.40 |

| Tennessee | 16,970 | $867.90 |

| Texas | 63,730 | $3,091.80 |

| Utah | 3,940 | $212.00 |

| Vermont | 1,930 | $95.80 |

| Virginia | 21,560 | $1,042.50 |

| Washington | 16,310 | $777.10 |

| West Virginia | 4,950 | $196.20 |

| Wisconsin | 12,220 | $576.10 |

| Wyoming | 1,230 | $61.50 |

| All Other Locations | 8,710 | $350.30 |

| TOTAL | 803,990 | $38,980.90 |

On Friday, President Biden released the following statement on his Administration’s action to deliver $39 billion in relief to more than 800,000 borrowers:

“I have long said that college should be a ticket to the middle class – not a burden that weighs down on families for decades.

“My Administration is delivering on that commitment. Starting today, over 800,000 student loan borrowers who have been repaying their loans for 20 years or more will see $39 billion of their loans discharged because of steps my Administration took to fix failures of the past. These borrowers will join the millions of people that my Administration has provided relief to over the past two years – resulting in over $116 billion in loan relief to over 3 million borrowers under my Administration.

“But we’re not stopping there. My Administration has worked hard to secure the largest increases to Pell Grants in a decade, fixed broken loan programs such as Public Service Loan Forgiveness, and created a new income-driven repayment plan that will cut undergraduate loan payments in half and bring monthly payments to zero for low-income borrowers. And, when the Supreme Court made the wrong decision, I immediately announced a new plan to open an alternative path to relief for as many borrowers as possible, as soon as possible.

“Republican lawmakers – who had no problem with the government forgiving millions of dollars of their own business loans – have tried everything they can to stop me from providing relief to hardworking Americans. Some are even objecting to the actions we announced today, which follows through on relief borrowers were promised, but never given, even when they had been making payments for decades. The hypocrisy is stunning, and the disregard for working and middle-class families is outrageous.

“As long as I’m in office, I will continue to work to bring the promise of college to every American.”

Vice President Harris also issued a statement, available here.

Eligible borrowers were notified by the Department starting last Friday that they qualify for forgiveness without further action on their part. Discharges will begin 30 days after those emails were sent. Borrowers who wish to opt out of the discharge for any reason should contact their loan servicer during this period. Borrowers will be notified by their servicer after their debt is discharged. Those receiving forgiveness will have repayment on those loans paused until their discharge is processed, while those who opt out of the discharge will return to repayment once payments resume.

“For far too long, borrowers fell through the cracks of a broken system that failed to keep accurate track of their progress towards forgiveness,” said U.S. Secretary of Education Miguel Cardona on Friday. “Today, the Biden-Harris Administration is taking another historic step to right these wrongs and announcing $39 billion in debt relief for another 804,000 borrowers. By fixing past administrative failures, we are ensuring everyone gets the forgiveness they deserve, just as we have done for public servants, students who were cheated by their colleges, and borrowers with permanent disabilities, including veterans. This Administration will not stop fighting to level the playing field in higher education.”

The Department will continue to identify and notify borrowers who reach the applicable forgiveness thresholds (240 or 300 qualifying monthly payments, depending on their repayment plan and type of loan) every two months until next year when all borrowers who are not yet eligible for forgiveness will have their payment counts updated. Any month counted for this purpose can also be counted toward PSLF if the borrower documents qualifying employment for that same period.

The data released today builds on the Biden-Harris Administration’s unparalleled record of student debt relief to date, including:

Ed.gov. 07/18/2023.

- $45 billion for 653,800 public servants through improvements to PSLF;

- $10.5 billion for 491,000 borrowers who have a total and permanent disability; and

- $22 billion for nearly 1.3 million borrowers who were cheated by their schools, saw their schools precipitously close, or are covered by related court settlements.

President Biden and the Department have also taken steps to help borrowers access affordable payments going forward. The Department recently issued final regulations creating the most affordable payment plan ever—the Saving on a Valuable Education (SAVE) plan. The SAVE plan will cut payments on undergraduate loans in half compared to other IDR plans, ensure that borrowers never see their balance grow as long as they keep up with their required payments, and protect more of a borrower’s income for basic needs. A single borrower who makes less than $15 an hour will not have to make any payments. Borrowers earning above that amount will save more than $1,000 a year on their payments compared to other IDR plans. Benefits from the SAVE plan will start becoming available this summer.

Ed.gov. 07/18/2023.

Islamic New Year Tweet

From Wednesday…

Google tells me 1445 Al-Hijra is spelled Al Hijri which is confirmed via The National News.com that explains; The first month of the Islamic calendar starts on Wednesday, July 19, which means the Hijri year 1445 begins on that day. A public holiday to mark the occasion will take place in the UAE on Friday, July 21. Muharram is the first of 12 months on the Islamic calendar. It is one of four sanctified months that are of particular reverence – the others are Rajab (7th), Dhu Al Qaeda (11th) and Dhu Al Hijjah (12th). As with other Islamic holidays, Muharram changes every year when the 354 or 355-day year is viewed against the lunar cycle.

Union Strong Tweets

From Wednesday…

The White House picnic starts at 6:00 p.m. D.C., time…

This is an Open Thread.

1 Trackback / Pingback

Comments are closed.